27 min reading time

Introduction to Female Entrepreneurship

In today’s rapidly evolving world, female entrepreneurs are at the forefront of innovation, creating businesses that impact not just economies, but societies as well. However, they often navigate a complex labyrinth of unique challenges across diverse sectors. This article delves into the heart of female entrepreneurship, illuminating the multifaceted struggles of women founders in industries ranging from technology to healthcare, finance, and more. We do not stop at highlighting problems; instead, we offer you tangible strategies for overcoming these hurdles. Join us as we decode the intriguing world of female entrepreneurship, and learn how to support the women innovators who are redefining the global business landscape.

The following blog post was created in cooperation with beatvest. beatvest is an educational investment platform for people interested in the stock market, founded in 2021. The app offers entertaining educational elements that provide the necessary knowledge for confident investment decisions. In addition, a fictional investment feature allows users to monitor investment movements and familiarize themselves with the financial market. For more information, visit https://www.beatvest.com/.

The Landscape of Female Entrepreneurship in Germany

In the German startup we encounter entrepreneurs from all walks of life, each contributing to the vibrant atmosphere with their unique ideas. But upon closer examination, an imbalance emerges. This first part of the article is based on the Female Founder Monitor and all the numbers can be found there as well.

Demographics of founders

Four out of five startup founders we meet are men, only one in five founders is a woman. In terms of exclusively female-led teams, the numbers are even smaller – just 12% of all founding teams.

Sure, there’s diversity, but it’s like a mosaic with too many missing pieces. Yes, women are part of the entrepreneurial ecosystem – 37% of current startups in Germany include at least one woman in their team. But their representation still falls short, significantly so.

Experience, too, is part of this uneven picture. In Germany, female founding teams, with a percentage of 26%, are less likely to have previous startup experience than their male counterparts (46%) or mixed teams (47%). Interestingly, when it comes to solo entrepreneurship, women seem to take the lead. 13% of female entrepreneurs start their business journey without a co-founder, significantly outnumbering their male counterparts, where only 6.4% start the company alone.

Focus on different industries

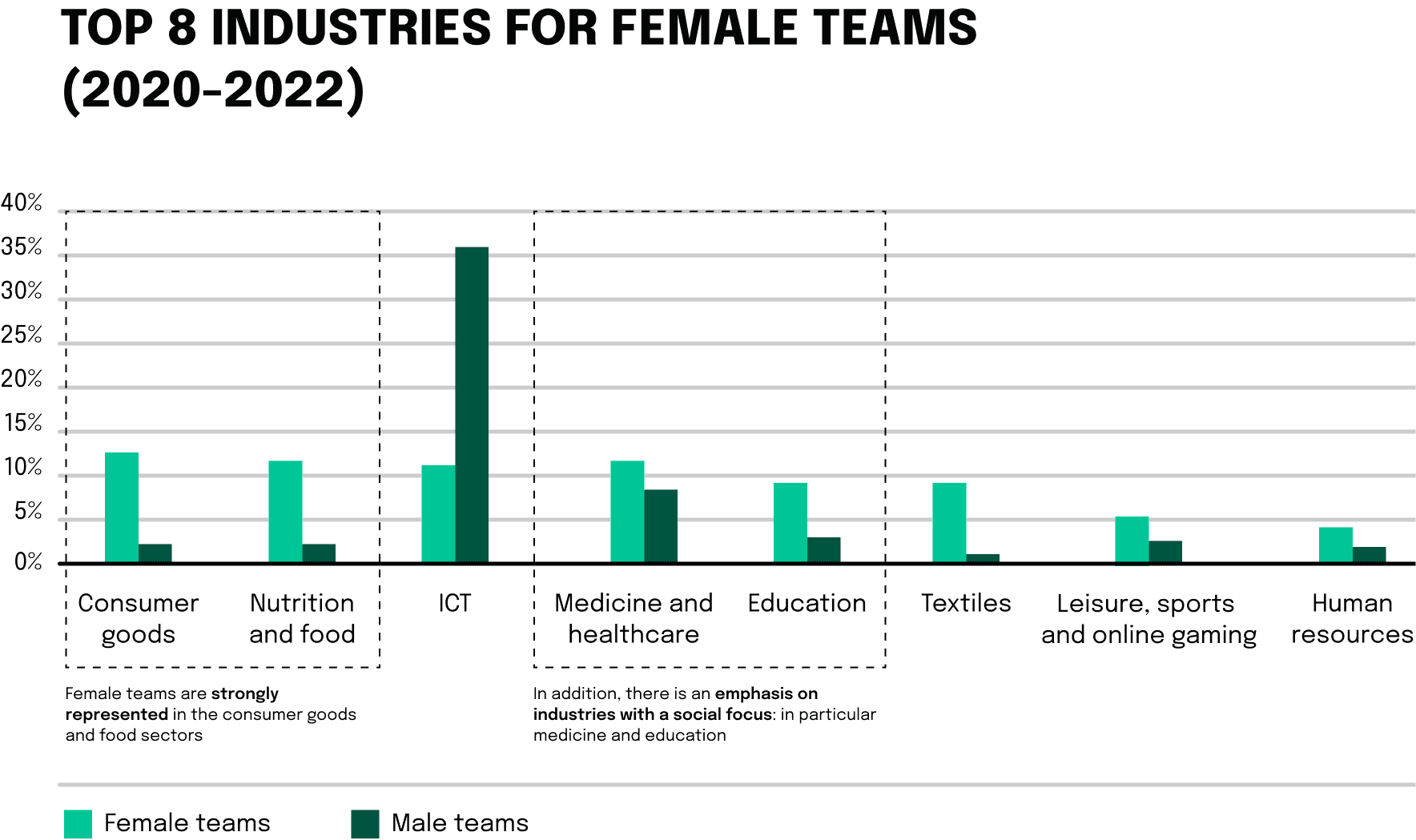

In the world of startups, the business-to-consumer (B2C) sector sees a higher prevalence of female entrepreneurs. From crafting unique consumer goods to revolutionizing the food industry, from innovating medical solutions to reshaping education. These sectors, focusing on personal wellbeing, learning, sustainability, and food production, speak to a diverse set of priorities and interests.

Diving deeper into the technology sector, the gender disparity becomes even more apparent. Here, male founder teams dominate, making up 35.8% of the sector. Women, on the other hand, contribute only 12.3%.

This industry-focused gender gap is a significant part of the puzzle when it comes to understanding why female founders frequently receive less funding. For example, let’s take a look at the United States, the market leader in venture capital. In 2022, software companies, a male-dominated sector, attracted a whopping $90 billion in VC investments. Commercial products and services, the second-largest sector, pulled in approximately $37 billion. Rounding out the top three was the pharma and biotech sector, with $31.3 billion in investments.

Interestingly, these sectors, particularly tech, are areas where male startups usually concentrate. As a result, the funding tends to follow. On the other hand, industries where female founders typically shine don’t see as much funding flow.

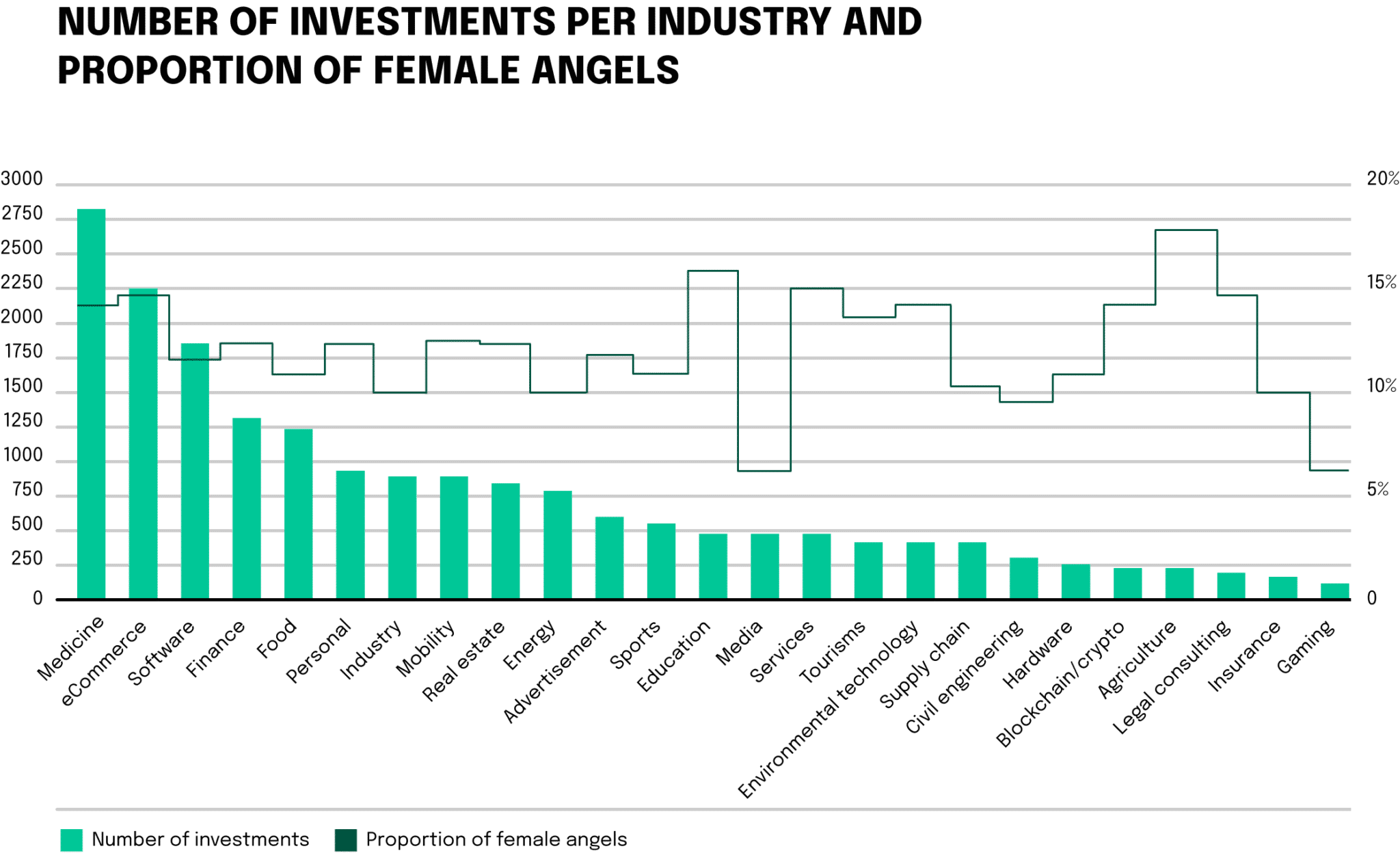

This is also visible when taking a look at female business angels in Germany. If we take a look at the focus investments for angel investors in Germany, there are interesting gender differences to observe as well. First we sadly also need to mention that the share of female business angels in Germany is low. Only 13.3% of angels are female. If we observe the investments made, most angel investments in German startups are in the sectors of health and e-commerce. Together, these two sectors account for over 26% of all angel investments in the period. At the same time, the share of female angels is also one of the highest in these sectors at 16%.

This highlights an important issue: the path to funding is not only affected by the entrepreneur’s gender but also by the industry in which they choose to operate. Missing networking opportunities also play a large role, so we will touch this topic later on in more detail!

Different founders, different business models

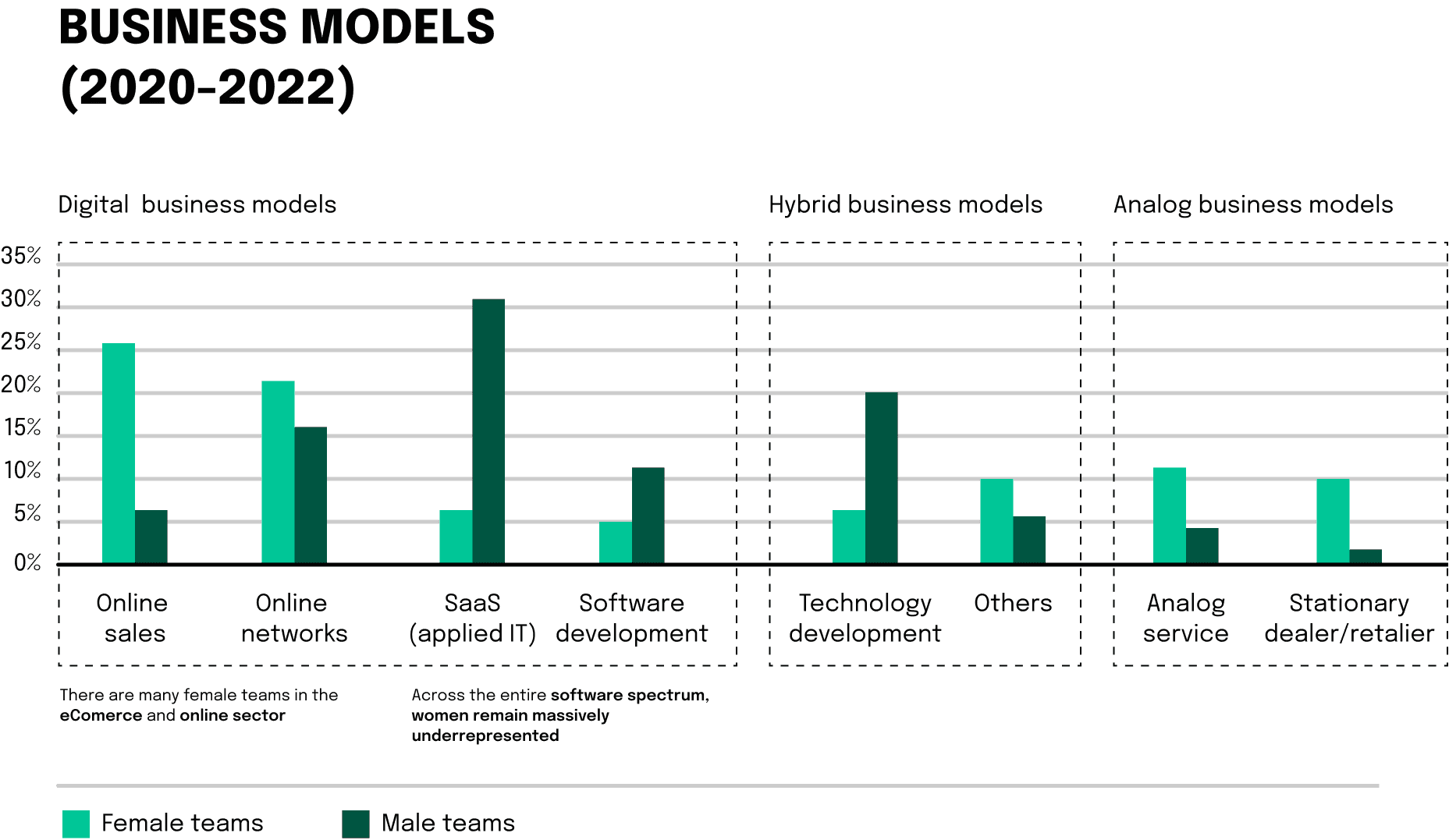

The entrepreneurial choices of women in Germany show a pattern, one that’s closely tied to the sectors they commonly operate in. They often opt for business models that align with consumer goods, food, and textiles. Interestingly, female teams outperform their male counterparts in digital sales models, holding a 25.6% share against a 7.2% male share. This statistic points to women’s growing involvement in digital commerce, leveraging the power of the internet to reach a broader customer base.

Contrastingly, Software as a Service (SaaS) – a popular business model for scalable, high-growth potential startups – sees a lower representation of women. Here, female teams comprise only 6.5%, while male teams dominate with a 32.4% share. A similar trend can be observed in software development, with female teams at 6.5% and male teams at 12.5%.

One possible explanation for this imbalance is the traditional gender divide seen in technology-related fields. Such divides can result in fewer women embarking on tech-driven entrepreneurial journeys, subsequently affecting their representation in digital-focused business models.

Notably, female teams show a greater inclination towards analog business models, which tend to be less scalable and therefore less attractive for venture capital or angel investments. For instance, stationary retail sees a female team share of 10.2%, compared to a male team share of just 2.3%. Analog services follow a similar pattern, with a 13.3% share for female teams and a 4.4% share for male teams.

Venture capitalists typically seek scalable, high-growth potential startups. SaaS, digital services, and tech-focused startups tend to fit this bill more often, explaining their attractiveness for VC investments. Given the current distribution of business models between genders, it becomes evident why male-led startups might receive more VC attention.

Identifying critical challenges for female founders

Every entrepreneur’s journey is marked by obstacles and triumphs alike, regardless of who they are. But it’s crucial to recognize that this journey isn’t uniform for everyone. The entrepreneurial path is often more challenging for women, cluttered with systematic, societal, and personal hurdles.

Access to capital: The persistent funding gap

In the entrepreneurial ecosystem, capital is king. Yet, access to funding frequently proves to be an uphill battle for female founders. Let’s explore this persistent gender funding gap.

A look at the investment patterns among German angel investors reveals that only 16% of all male angel investments land in startups co-managed by women. Conversely, female angels demonstrate a stronger affinity towards women-led ventures, directing 26% of their investments into such startups. This disparity reflects not only gender biases but also highlights the need for more female investors to balance the scales.

When we scrutinize the investment amounts, the divide becomes stark. Women-only teams, on average, receive nine times less funding than their male-only counterparts. The numbers speak volumes about the gender imbalance in startup financing.

Interestingly, while the likelihood of securing funding is almost the same for female and male teams (62% vs. 64%), the magnitude of the funds received varies considerably. Women-led teams, on average, seek €1.6 million in capital, a figure that lags by a factor of three compared to their male peers. This tendency towards more conservative financial planning may stem from a myriad of factors, including lower investor confidence, more limited networks, and the challenges of breaking into traditionally male-dominated sectors. This gap suggests a disconnect between female founders and the investment sector, pointing towards biases and potential areas of improvement.

Gender bias and stereotypes: The societal and professional challenges

If we already talk about norms, there are multiple norms and biases not in favor of female founders throughout the VC financing process.

Let’s first take a look at the VC process of getting funding. The VC investment process has four stages: 1) deal sourcing, 2) pitching, 3) due diligence, and 4) closing. Especially in the pitching stages, there are some interesting, and rather unfortunate biases observable.

Investors prefer attractive men

One study from 2014 observes the gender differences during VC pitching stages. Especially here, investors are exposed to biases because of a lot of personal contact with the different founders.

The entrepreneur’s business proposition and previous experience are regarded as the main criteria for investment decisions. The research, however, documents other critical criteria that investors use to make these decisions: the gender and physical attractiveness of the entrepreneurs themselves. Investors prefer pitches presented by male entrepreneurs compared with pitches made by female entrepreneurs, even when the content of the pitch is the same. This effect is moderated by male physical attractiveness: attractive males were particularly persuasive, whereas physical beauty did not matter among female entrepreneurs. Interestingly, these results did not change, even if the investor was a female as well. The end result is rather shocking: the same idea pitched by an attractive man is at least 60 % more likely to get funding than one from a woman.

The difference in questions female founders get asked

Another study observed Q&A interactions between 140 prominent venture capitalists (40% of them female) and 189 entrepreneurs (12% female) that took place at TechCrunch Disrupt New York, an annual startup funding competition. Afterward, the authors tracked all funding rounds for the startups that launched at the competition. These startups were comparable in terms of quality and capital needs, yet their total amounts of funding raised over time differed significantly: male teams in our sample raised five times more funding than female-led ones.

But what is the reason here? The key is in the regulatory focus theory. It addresses the motivations that people have in goal pursuit, particularly as those motivations address the achievement of end results of an interaction. Individuals with a prevention focus are concerned with negative consequences and are sensitive to goal impediments. Their goal is to avoid negative consequences, and they are concerned with safety, responsibility, and failures of commission. On the other hand, people with a promotion focus are driven by potential positive consequences of their behavior and are sensitive to opportunities for goal advancement. In the observed Q&As, the study found that 67% of the questions posed to male entrepreneurs were promotion-oriented, while 66% of those posed to female entrepreneurs were prevention-oriented.

This difference in questioning appears to have substantial funding consequences for startups. Ultimately, the study observed that entrepreneurs who answered mostly prevention questions went on to raise an average of $2.3 million in aggregate funds for their startups through 2017. This is about seven times less than the $16.8 million raised on average by entrepreneurs who were asked mostly promotion questions.

The juggling act: Work-life balance issues

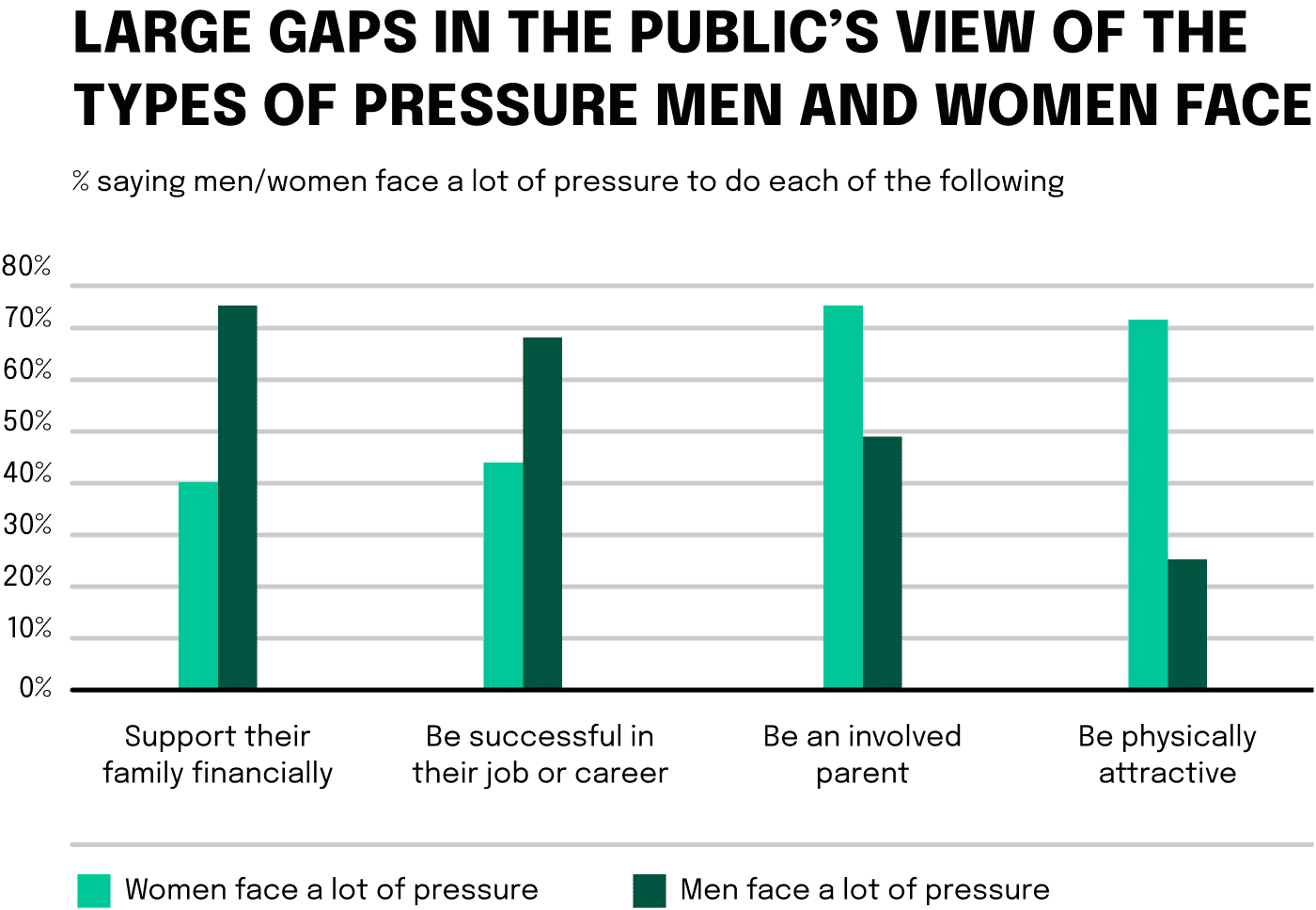

If we observe social norms and gender roles, there are still significant imbalances present. Let’s take a look at social expectations in the U.S. for example: The public has very different views about what society values most in men and what it values in women. While many say that society values honesty, morality, and professional success in men, the top qualities for women are physical attractiveness and being nurturing and empathetic. Additionally, there are 11% specifically mention being a parent or caregiver, and 6% mention traits like kindness or being helpful. Social pressure also emphasizes largely different parts of life, as is visible in the following graphic:

These social norms and expectations can put additional pressure on women when deciding to start a company. It’s noteworthy that the entrepreneurial journey and the phase of family planning often align: 41% of female founders and 44% of male founders are also parents. This overlapping life stage presents unique challenges and considerations for these entrepreneurs, especially women.

When we inspect the weekly working hours, we find that female founders with children typically work nearly six hours less compared to their male counterparts. This statistic underscores the ‘double shift’ that many working mothers grapple with, juggling business demands with familial responsibilities.

Satisfaction levels further illuminate this struggle. When asked about the compatibility of family and entrepreneurship, only 51% of female founders reported satisfaction, compared to 61% of male founders. This divergence points to the added pressures women frequently face when navigating the entrepreneurial landscape as parents.

Overcoming hurdles: The winning strategies

So far, we have talked a lot about the imbalances and the challenges to female entrepreneurship. But why exactly is it so important to eliminate these imbalances? To put it in simple terms, it would just create a lot of additional value.

VC firm First Round reported that its investments in female-founded companies performed 63 percent better than those in all-male venture teams. Women also run more capital-efficient companies achieving 35 percent higher ROI. Additionally, women-owned businesses are growing much faster. A study conducted by BCG found a statistically significant correlation between the diversity of management teams and overall innovation. This trend is not only visible when observing the startup ecosystem. Companies in the MSCI World Index with strong women leadership generated a Return on Equity of 10.1% per year versus 7.4% for those without.

But how can we eliminate these differences exactly?

Debiasing the VC world

We have already established that female lead start-ups receive a lot less money compared to male founders. But, male decision-makers largely drive the VC world. So obviously, the VC decisions are then primarily based on heuristics derived by men. Indeed, less than 10% of decision-makers at VC firms are women and 74% of U.S. VC firms have no female investors. For other European countries, it does not look more promising. Consider the U.K.: just 11% of senior investment roles at UK firms and their European offices are held by women.

This all can lead to a similarity bias: the tendency to prefer people who are similar to oneself. In the context of VC, this can lead investors to favor founders who have similar backgrounds, educations, or experiences similiar to their own, even if these factors are not directly related to the success of the startup.

But what are some tactics to debias the VC ecosystem? Well, a start would be to have a diverse team. Made up of different ethnic and cultural backgrounds, with a better-than-average gender split, a diverse team typically outperforms the market average in terms of their decision-making. A more comprehensive list of 10 other methods of how VCs can debias themselves can be found here. But there are other tools out there that help to rationalize the investment process: Founders Factory, a U.K. startup accelerator, has developed an AI platform that identifies high-potential entrepreneurs. The software crawls Google, CrunchBase, and LinkedIn, looking for characteristics that push entrepreneurs to succeed. That includes their education, awards, whether they started businesses at school, their extracurricular activities, their pace of career advancement, and their ability to do cross-disciplinary roles. Without being biased by attractiveness or gender. Perhaps these AI-based venture scouting tools can bring more balance to the VC ecosystem.

Female angel investors as drivers of equality

At present, the investor landscape remains significantly male-biased, with 86.2% of business angels being men. These individuals are typically well-educated, middle-aged, and, in many cases, highly qualified, with an above-average 11.4% possessing a doctorate or professional degree.

Organizations like the Business Angels Deutschland e.V. (BAND) are spearheading initiatives to change this narrative. Their Women Angels Mission ’25 is an ambitious endeavor that aims to elevate the percentage of female business angels to 25% by 2025. Indeed, female business angels have shown a distinct inclination towards backing female-led startups, with 26% of their investments supporting such ventures. This is a marked contrast to their male counterparts and provides a more accurate reflection of the ratio of male- and female-led startups in the ecosystem.

To boost the participation of women in angel investing, we must adopt multifaceted strategies:

- Promotion and Advocacy: Introduce educational programs and mentorship schemes that provide women with the necessary tools and confidence to become angel investors.

- Building Community: Develop networking spaces that allow female angels to collaborate, share experiences, and offer mutual support. Existing angel networks should strive to be more inclusive and diverse.

- Investment Channels: Creating dedicated platforms that connect female angels with female entrepreneurs seeking investment. This reciprocal approach not only boosts funding for female-led ventures but also encourages more women to step into investing roles.

Enriching the entrepreneurial experience: networking and mentorship for more equality

Creating a thriving entrepreneurial ecosystem hinges on connections. They are the lifeblood that nurtures success stories, fostering crucial relationships, facilitating knowledge transfer, and opening doors to untapped opportunities. However, for many women at the helm of startups, these vital networking and mentorship avenues remain distressingly out of reach. Addressing this gap involves not just forging new paths, but making the old ones accessible to all.

Reinventing Networks for Female Founders

Women-centric business networks serve as a beacon of support and a hub for collective growth. These platforms provide much-needed space where women in business can pool their experiences, learn, and collaborate. But merely existing isn’t enough — these networks need to be not just reachable but also responsive, precipitating tangible opportunities for their members.

1. Digital Convergence: The creation of comprehensive digital platforms can unite female founders across the globe, enabling them to exchange insights, pool resources, and form strategic alliances.

2. Linking Opportunities: Implementing programs that pair female founders with potential investors, collaborators, and clients can open new doors. Such initiatives can take the form of pitching events, online networking hubs, or business exhibitions.

Expanding Mentorship Horizons

Mentorship can act as a guiding light, offering a wealth of advice, industry-specific wisdom, and support. But the majority of such programs remain rooted in male-dominated perspectives. To usher in change, we need to infuse inclusivity into these programs, making them responsive to the requirements of female founders.

1. Mosaic of Mentors: Inviting a broad spectrum of mentors, including successful female entrepreneurs, industry experts, and investors, can inject diversity into the pool of available advice and perspectives.

2. Customized Guidance: Designing mentorship schemes that take into account the unique trials faced by women — from balancing familial responsibilities with work to circumventing funding biases — can help them navigate their journey more confidently.

Breaching Established Networks

Many of the traditional business networks have been skewed towards males. These well-entrenched networks, brimming with invaluable experiences and connections, can offer a treasure trove of benefits to female founders if made accessible.

1. Inclusive Shifts: Advocacy for these long-established networks to evolve their policies, encouraging a surge in female memberships and active participation.

2. Bridging Divides: Initiatives that link women entrepreneurs with members of these networks can prove beneficial. Collaborative programs, shared events, or reciprocal projects could serve this purpose.

A holistic approach to entrepreneurial parity involves equal access to networking and mentorship opportunities. By diversifying these spaces, we can bolster the prospects of female founders, paving the way for an innovative, vibrant, and balanced entrepreneurial landscape.

How four female founders are shaping the finance and tech industries

In the thrilling realm of entrepreneurship, success is never a straight line but rather a compelling story filled with challenges, learning, and triumphs. Let’s delve into the awe-inspiring narratives of five formidable women who have etched their success stories in the finance and tech industries.

Jaylyn Schnau: Pumpkin Organics

Embarking on an impressive journey through the landscape of children’s nutrition, Jaclyn Schnau, founder of Pumpkin Organics, has reshaped the narrative around baby and toddler food in Germany. In the midst of a marketplace overflowing with subpar choices, Schnau, a mother herself, recognized the pressing necessity for wholesome, organic, and nutritionally-dense alternatives.

This led to the creation of Pumpkin Organics, a brand now synonymous with organic, nutrition-focused purées, laying the groundwork for healthy eating habits in young children. A steadfast commitment to superior quality, the insistence on organic ingredients, and a deeply ingrained ethos of sustainability have made Schnau’s Pumpkin Organics a leading example of successful female entrepreneurship in Germany.

Ida Tin: Clue

Ida Tin, co-founder, and CEO of Clue, has revolutionized women’s health tech with her Berlin-based start-up. The Clue app, helping millions of women track their menstrual cycles, has been a game-changer in personal health management. As a torchbearer in the “Femtech” sphere, Tin has used advanced technology to augment women’s health and wellness, making Clue a global sensation. Her visionary approach, coupled with an emphasis on user experience, are the pillars of her success.

Lisa-Maria Fassl: Fund F & Female Founders

As an embodiment of entrepreneurial leadership and innovative spirit, Lisa-Marie Fassl, Managing Partner at Fund F and Co-Founder of Female Founders, is a stellar figure in Germany’s and Austria’s startup landscape. Holding dual roles, she has not only paved the way for gender-diverse digital startups through her strategic investments with Fund F but also significantly bolstered women’s representation in the startup scene with her initiative, Female Founders.

Her tireless endeavors aim to bridge the gender gap in entrepreneurship, creating an ecosystem ripe with resources, mentorship, and networking opportunities specifically for women. It’s a clear call for diversity and a testament to her commitment to making the dream of gender parity in entrepreneurship more tangible.

Aiga Senftleben: Billie

A trailblazer in the FinTech world, Aiga Senftleben, co-founder of Billie, is a testament to successful female entrepreneurship in the finance industry. With Billie, she disrupted the small and medium-sized enterprise (SME) sector in Germany by providing fast, straightforward invoice financing solutions that streamline cash flow for B2B clients.

Her innovative business model challenged the status quo of traditional lending, opening new avenues for SMEs to thrive. Senftleben’s role at Billie is a shining example of how innovative solutions can shake up long-standing industries and illustrates her commitment to offering robust financial solutions for SMEs. Her success underscores the significant potential of female leadership in traditionally male-dominated sectors.

These four women, through their journey and accomplishments, signify that success is not a closed club. They have broken barriers and defied stereotypes, turning adversities into opportunities. Their narratives serve as a beacon of inspiration, underscoring that with unwavering persistence, strategic vision, and the audacity to dare, no barriers are insurmountable.

neosfer GmbH

Eschersheimer Landstr 6

60322 Frankfurt am Main

Teil der Commerzbank Gruppe

+49 69 71 91 38 7 – 0 info@neosfer.de presse@neosfer.de bewerbung@neosfer.de