17min reading time

The year is coming to an end and so, not only Spotify is sending you a recap of 2022! In this article, we provide you with a summary of the year in Tech, Sustainability, Banking, and VC highlighting the key developments that we at neosfer consider most important.

The tech year 2022

Metaverse, Web3.0, artificial intelligence or DeFi — which technologies will significantly shape business and society in the coming years? A big question that 2022 could not answer. However, we still want to give a wrap-up of the technological trends that we found the most compelling over the last 12 months.

Convergence of cloud, network and devices

The rapid development of new network technologies is accelerating the evolution of cloud computing towards a new computing system – the convergence of cloud, network and devices with a clear division of work. It acts as a catalyst for more demanding applications such as highly precise industry simulations — as well as real-time quality checks and mixed reality. Huaweis’s research department names the connection of cloud computing, networks and devices as the key element for a faster and more efficient digital transformation.

The Metaverse

Blending of virtual and real worlds

Artificial Intelligence

OpenAI, ChatGPT, Dall-E 2, the ada chatbot – these are only some of the most recent AI software tools creating a lot of buzz on the web. Artificial intelligence for sure is one of the major tech trends of 2022 and might have dramatic influence on different industries (think of journalism for instance).

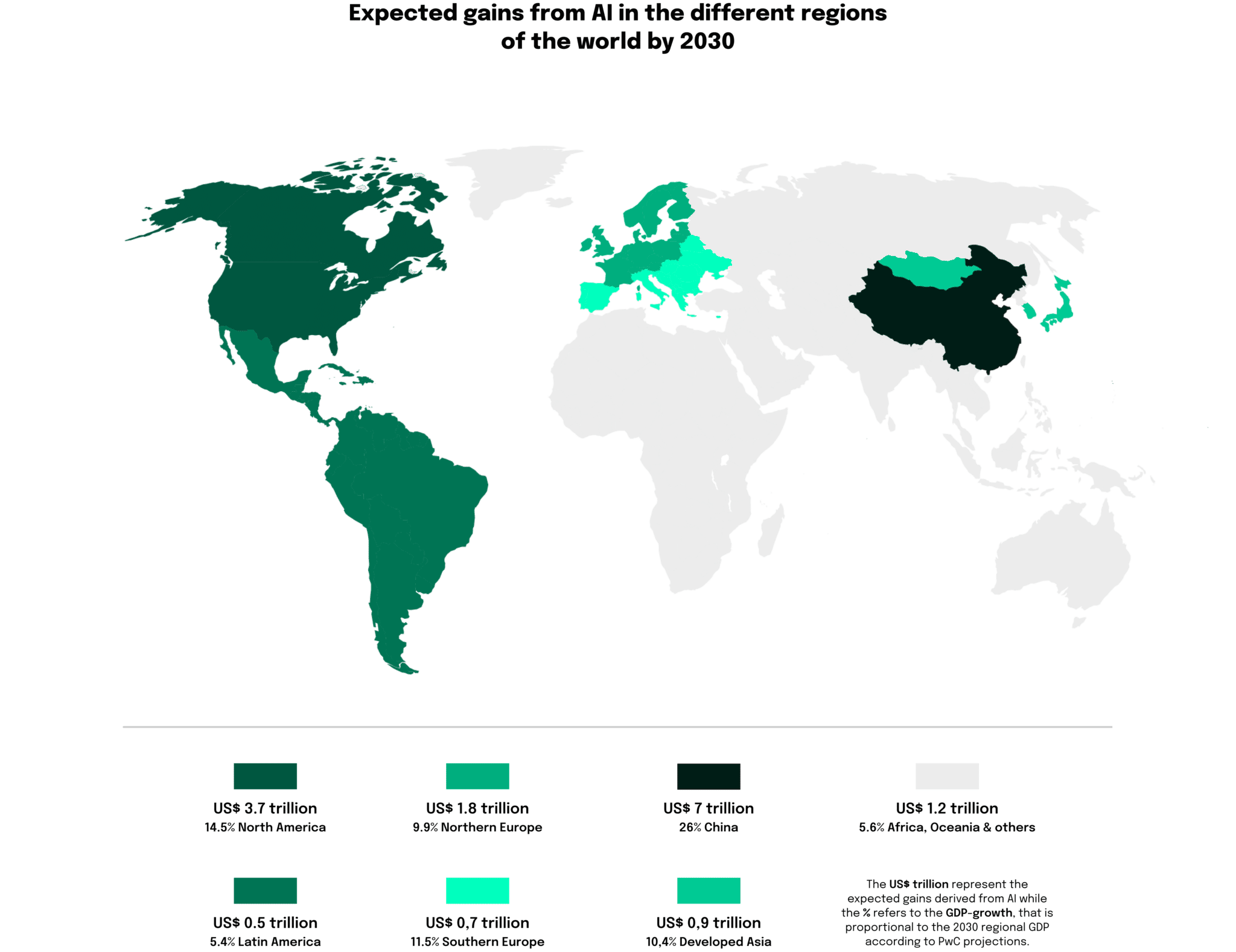

However, this trend will not die out at the end of the year as the economic potential of the technology is just too big. A study by PwC estimates that global GDP may increase by up to 14%, in absolute terms more than US$15 trillion, by 2030 as a result of the accelerating development and take-up of AI.

The year 2022 in sustainability

Even though the first year of the corona pandemic saw a drop of over 8% in global carbon emissions — the sharpest decline in recorded history — the year 2022 was full of setbacks for the world’s sustainability and climate goals.

Nonetheless, we also want to elaborate on a couple of positive and interesting developments in the field of sustainability, ranging from renewable energy, electric vehicles to sustainable regulations.

2022 – the year of tighter regulations

As we have discovered in our article about sustainable regulation, the Agenda 2030 and the Paris Agreement are not enough to reach all sustainable development goals. Therefore, the year 2022 has seen some key Europe-wide and national regulatory changes to further boost a sustainable future. Some of which, we want to shortly mention to underline national and Europe-wide efforts to reduce carbon emissions, or to make the economy more transparent.

The European Union has announced a new regulatory framework to impose a carbon dioxide tariff on imports of polluting goods such as steel and cement. Named the “Carbon Border Adjustment Mechanism”, the agreement will cover industrial imports from the 27 member states, targeting the highest polluting products first. This legislation will increase the pressure on companies that nonetheless need to align with tighter reporting standards like the NFRD or (even newer) the CSDR. The CSDR will come into effect in 2024 and will extend the reporting requirements to “Double Materiality”, other forward-looking information, including targets and progress of sustainable transformation aligned with the SDGs, information on intangible assets, reporting in accordance with the Sustainable Finance Disclosure Regulation (SFDR) and the EU Taxonomy Regulation.

Belgium will impose new taxes on older, noisier planes as well as private jets and short-haul flights, with the aim to reduce unnecessary emissions and noise starting in April 2023. France has been given the green light to ban short-haul domestic flights. The European regulators have approved the move which will abolish flights between cities that are linked by a train journey of less than 2.5 hours.

The future for net zero energy

Information based on the latest Climate Watch data highlights that energy usage contributes to 73.2% of global greenhouse gas emissions. This is far and away the highest contributor, with the second-highest being agriculture, at 18.4%.

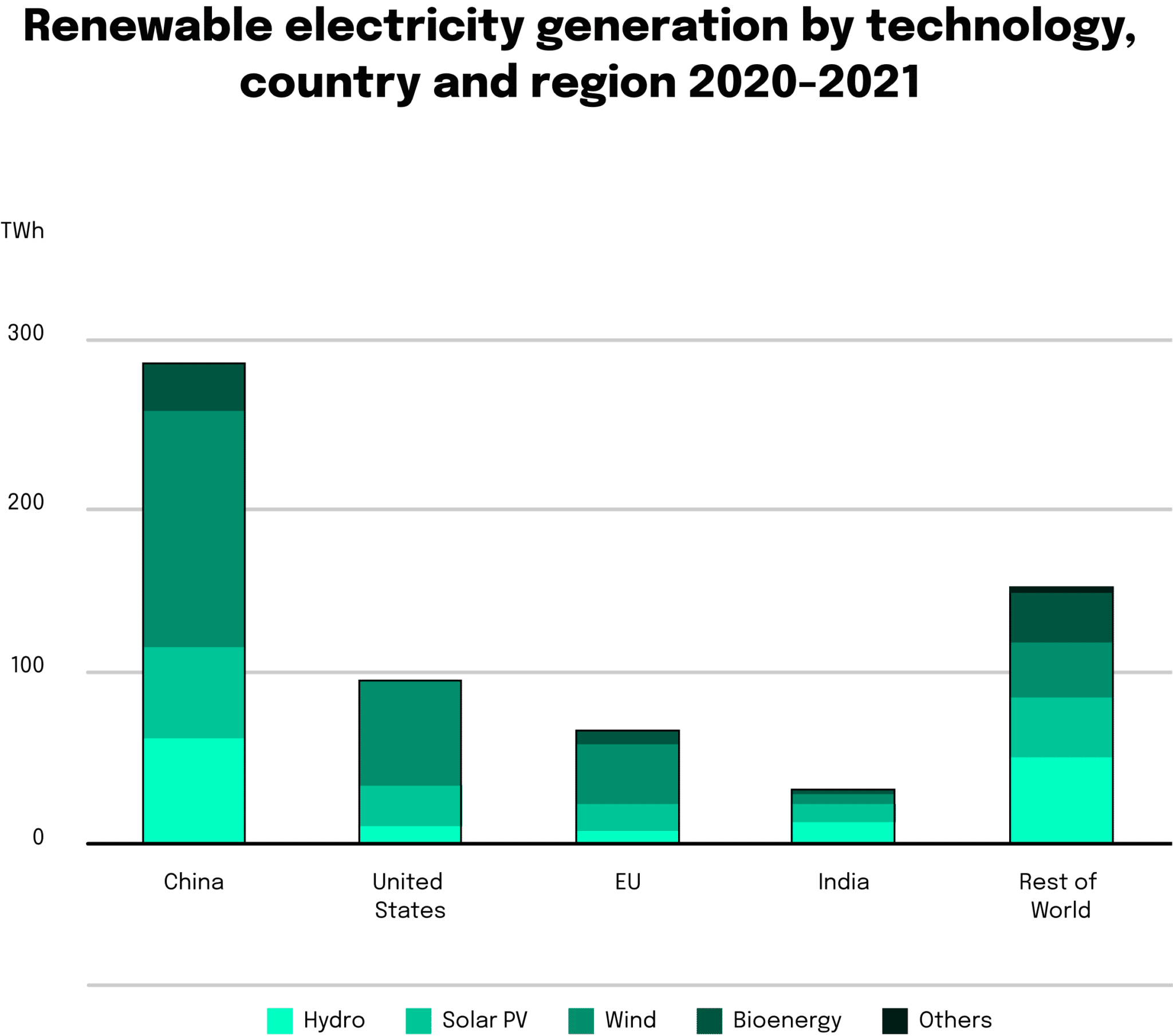

Likewise, it is no surprise that energy generation has seen the highest levels of interest and progress. In the past year, we have seen record growth in renewable energy sources such as solar and wind, which grew at 23% and 12%, respectively.

Electricity generated from renewable sources grew by 7%, and the contribution of renewable sources to the global grid rose to its highest ever share of 29%. But with the Russian invasion into Ukraine, a discussion around the topic of nuclear energy as a contributor for clean energy arose again. Between 2020 and the end of 2021, up to 17 new nuclear reactors were slated to go online globally. While nuclear sources currently generate only 10.3% of the world’s energy, these increases will boost nuclear’s output in developing economies to over 30%.

Electric vehicles and their road towards sustainability

Before the pandemic, transportation accounted for 16.2% of greenhouse gas emissions, with road transport responsible for 73.4% of those emissions. 18 out of the world’s 20 largest automotive manufacturers — that account for nearly 90% of global car sales — have switched or pledged to switch, either completely or significantly, to manufacturing EVs in the coming years. However, as of the beginning of this year, electric vehicles still were set back by the sustainability of lithium-ion batteries, limited range due to high weight and the overall high cost of EVs for the end-consumer.

Besides some innovations to charging infrastructure, we may soon see one more change to EVs: Scientists from MIT have created a new kind of battery. Moving away from the traditional lithium-ion model, the new battery is made from aluminium and sulfur. As these new batteries would be extremely energy-dense, they can have up to four times the storage capacity compared to lithium-ion batteries. Not only a breakthrough for electric vehicles but also for the storage of all green energy in the future.

Carbon removal to reduce human influence on the atmosphere

Sadly, we can observe that carbon emissions are on the rise again after 2020. The UN Intergovernmental Panel on Climate Change (IPCC) estimates that we need to remove up to 1,000 gigatons of carbon dioxide from the atmosphere by the end of the current century. This most likely will not be possible with restoring forests, swamps, or marshlands. We need alternative solutions!

Enter the era of carbon removal: human activities that remove CO2 from the atmosphere and durably store it in geological, terrestrial or ocean reservoirs. The first active carbon removal plants are already in action as we write this sentence. The first project, The Orca carbon capture plant, is a facility that uses direct air capture to remove carbon dioxide and is in operation since late 2021 in Iceland. The extracted CO2 is mixed with water and pushed into the ground, where it is stored long-term. A similar plant is now planned and approved in the UK. The Keadby 3 plant in north Lincolnshire is the first carbon capture and storage project that got approval by the British government. It has the potential to store up to 1.5 million tonnes of CO2 from the air every year. A promising development for a greener future and less carbon dioxide in our atmosphere.

Banking in 2022 - our recap

As can be observed from the strong development and innovative power of the FinTech industry over the last couple of years, banking, and tech are continuing to merge. As a matter of fact, you will see this development in our analysis of the year 2022, and some banking innovations might as well be placed into our tech recap.

Banks offering embedded solutions

Embedded finance has been a growing trend over the past year and is well-positioned to grow even further as numerous banks look to become service providers to non-bank and non-financial institutions. For these institutions, if they are looking to deliver a customer experience or service proposition involving financial services as a component of a larger offering, embedded solutions offered by banks might be beneficial. This integration means a real embedding of such services in the product range of a company, often integrated in the processes between selection, ordering, purchase and payment.

Examples of embedded finance are the following: The loan to buy furniture is available directly from the furniture retailer, the insurance for the new car is taken out directly with the car dealer, similar to the purchase of a cell phone. In most cases, a bank or a financial services provider with a banking license is behind these financial services integrated on external platforms. Exactly this development was one major banking tech trend in 2022.

Buy now pay later

Buy now, pay later, or BNPL for short, is more than a trend – it can also be an important service. BNPL short-term financing that allows consumers to make purchases and pay for them at a future date, often interest-free. Multiple companies are offering BNPL services, including Klarna and Affirm, that offer buy now, pay later financing on purchases made from participating merchants. PayPal has introduced its point of sale installment loan program as well. But there are also new companies entering the BNPL market. Companies like Mondu, Hokodo and Billie have discovered a new customer group: companies. This approach has drawn a lot of attention from VCs as well, there are expectations of the BNPL B2B market hitting $200 billion in the upcoming years.

Besides new companies, the first banks are introducing their own BNPL services. Chase and American Express have also set up similar financing arrangements. One major cooperation between a FinTech and a classical financial institution is Visa and Credi2. Credi2 and Visa are developing a flexible product as part of the Visa Fintech Partner Connect program that will enable BNPL simply via Visa card in Central European markets in the future .

Even in times of volatility in bearish markets, the BNPL business model seems promising. The global market is expected to grow from $71.20 billion in 2021 to $103.60 billion in 2022 at an annual growth rate (CAGR) of 45.5%. The growth is not expected to slow down in the next years, with CAGR of 45.7% until 2026, when the market is expected to hit a value of $467.34 billion. The high-growth rates are driven by the adoption of online payment methods by an ever-growing audience. Technological leadership is a core interest of many digital leaders, so incorporating BNPL services into the payment process of major online retailers if giving the whole market an additional push. As BNPL is a market with a lot of potential and dynamic, we have committed a whole podcast to that topic, so listen closely!

Discovering Gen Z

Gen Z is entering the market more and more visibly, but how can they be reached? Is the financial industry even trying enough or in the right ways? Not only our podcast tried to answer these questions in more detail, but banks around the world did as well.

Today, people consult themselves more and gather the information themselves. TikTok and other social media channels with fast-paced content and various influencers seem to have a big effect if banks want to leverage their position for this new target group. But also interactive banking apps, control for parents of really young banking clients and more communication on an eye-to-eye level seem to make the difference here.

A great case study for this development is a company called Ruuky. Its communication strategy focuses exclusively on the target group of 14- to 24-year-olds. The banking app, a great example of what “Vertical Banking” is all about, is significantly more interactive and allows tracking of spending in real time. Parents can track their children’s payments via a web-based dashboard, configure the debit card and block it if necessary. At the same time, it is possible for young people to better understand their spending habits via automatic and intelligent classification and become more aware of them through an educational content approach. This development can be of real interest for other more classical and bigger banks trying to discover this new and younger target group. Our podcast episode 52 covers exactly this topic of how these examples of vertical banking with a focus on Gen Z can help families to improve their financial literacy.

The rollercoaster of crypto and digital assets in 2022

Remember 12 months ago when bitcoin was trading at a peak of $68,000, when we thought that the trading of Non-fungible token (NFTs) was a major mainstream trend? When Coinbase was trading at a record and the NBA’s Miami Heat was just into its first full season in the newly renamed FTX Arena?

But what exactly happened to bitcoin, Ethereum and other cryptocurrencies? The idea was that these cryptocurrencies can act as a hedge against inflation. Sounded good in theory, but then reality hit in 2022. When inflation rose, tight now near a 40-year-high, bitcoin has proven to be another speculative asset that bubbles up when the evangelists are behind it and plunges when enthusiasm melts and investors get scared. Additionally, to being a speculative asset, as we highlighted in one of our blog articles, decentralized assets are still traded on centralized exchanges. This is in direct contrast to the key idea of cryptocurrencies or Web 3.0 – the exclusion of intermediaries or third-parties. Result of this situation: bitcoin, at the moment of us writing this article, trades below $16,000. And you for sure also hear about the drama surrounding FTX! In the blink of an eye, FTX sank from a $32 billion valuation all the way to bankruptcy as liquidity dried up, customers demanded withdrawals and rival exchange Binance excited their nonbinding agreement to buy the exchange. A really extensive wrap-up of the crypto year 2022 can be found here. With all the negative trends in the crypto scene, the innovative power of the pure technology of blockchain and Web 3.0 is still unchallenged and can offer great economic benefits in the future!

Who would have thought that after trading NFTs in 2021 hit $17.6 billion, reflecting an eye-watering 21,000% surge from 2020s total of $82 million, the whole market would hit a massive dip at the end of 2022. In September 2022, daily NFT trading volume on OpenSea was down nearly 99% from its May 1 peak of $405.75 million, with a daily volume of around $10.29 million. Yaroslav Shakula, CEO of Yard Hub, had the following to say about the dip: “NFTs have surely been affected by the bear market but, in numerous instances, less severely than classic crypto and altcoins. What will happen next depends on the global political and macroeconomic situation. All tech stocks and risky assets are now tanking against the U.S. dollar, so in a short- and mid-term period, one might expect fluctuations in NFT prices as well.” There are still numerous people with bullish outlooks on the NFT market, citing strong economic potential of NFTs for classical business and the common consumer.

Venture capital in 2022

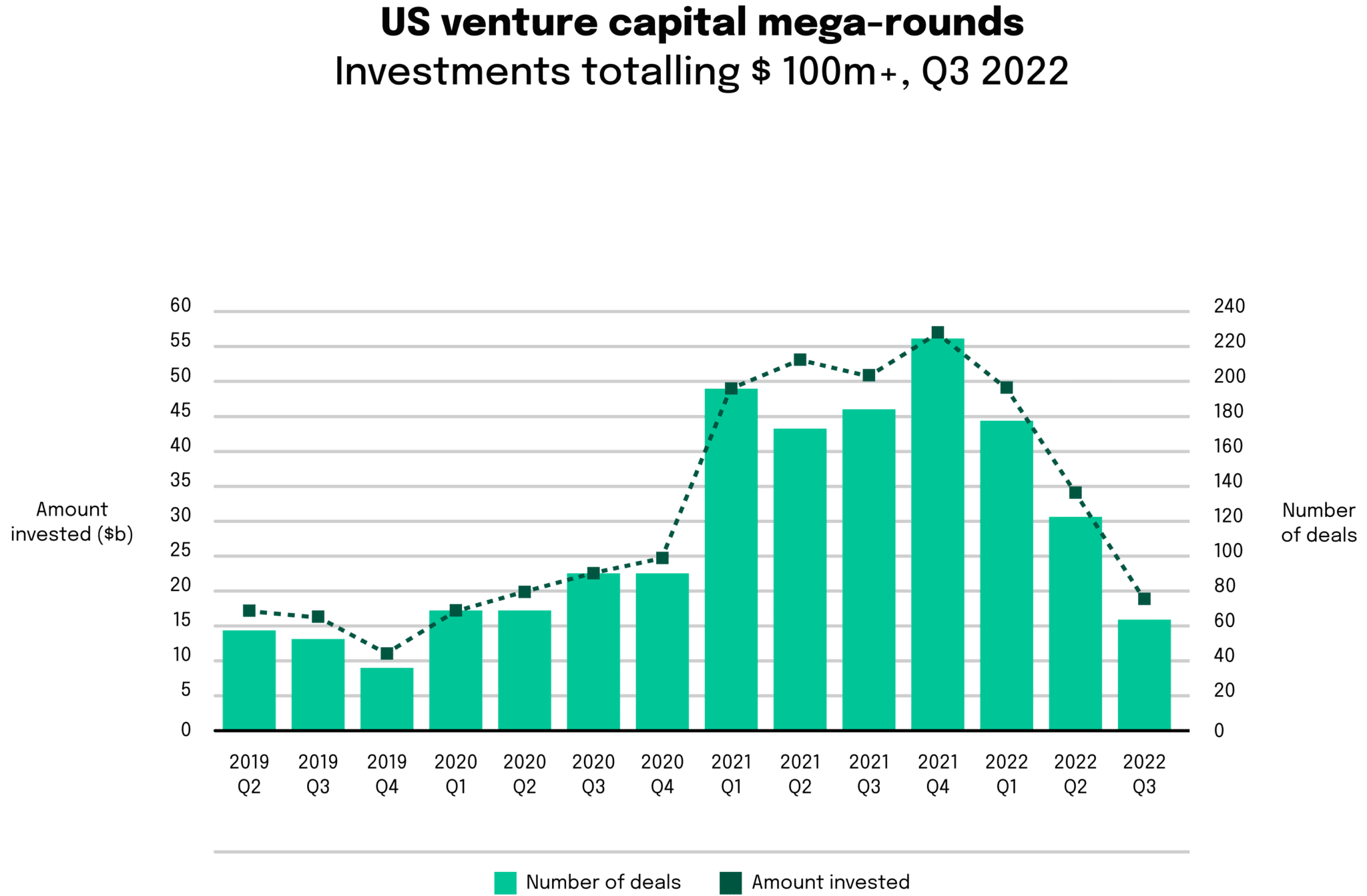

As we already have numbers for the U.S. VC investment, we can take those analyses as a proxy for general developments in the VC space. For the U.S., VC investments continued to weaken from the record-setting levels of 2021, declining by 37% in Q3 2022, from $60 billion in Q2 to $37 billion invested. Even with this significant drop-off, 2022 is already the second-highest investment year on record. In addition, total investment is expected to hit the $200 billion mark for the second year in a row and the fifth successive year of more than $100 billion in VC funding.

Mega-round financing

While all deal classes were down significantly, late-stage deals were down more than 50%, driven by a lack of mega-rounds. Mega-rounds have driven the strong growth recently, and this has contributed significantly to the reversal. IT, in “normal” years always the leading sector, is off 54% quarter over quarter. Software had its first sub $10 billion quarter since Q4 2020. This trend is one of the major other VC trends of 2022, which we will observe next.

Unicorns under pressure and a lot of dry powder

As IT did not raise as much venture capital as in 2021 or 2022, some unicorns have come under some pressure. There are roughly 1,200 globally. But there is an extremely high amount of pressure building for those unicorns on top of the food chain. A lot of these companies have raised capital on very high revenue multiples. Their valuations cannot be sustained over the coming year. Their growth has also largely not been able to keep up with the valuation that they’ve seen. In July of this year, Stripe took a 28% cut on the internal valuation of its shares. Klarna also confirmed in the same month that its valuation was slashed 85% from US$45.6bn to just $6.7bn after an $800 million funding round in which it raised capital from the likes of Sequoia, Silver Lake and the Canada Pension Plan Investment Board.

However, there is still light at the end of the tunnel. The global VC industry has more than US$500 billion in dry powder, which will provide short-term insulation from market turbulence. Year to date, VC fundraising reached $151 billion, marking the fifth consecutive record year of fundraising. So, even if some VCs stopped investing their funds into new start-ups, and we have seen countless memes about this, there is still enough money to be invested for the following months to come. Even if markets are uncertain and volatile, VC will get back to investing in 2023.

Changing focus in VC-backed entrepreneurs

Companies are now adopting a more defensive posture as entrepreneurs and investors are learning how to navigate through a vastly different landscape than what came before. Market volatility continues to persist due to inflationary pressures, rising interest rates and recessionary fears.

To combat this market volatility, a change in VC-backed founders can be witnessed. To weather the looming economic storm, entrepreneurs focus more on execution, customer retention and unit economics. Organic growth without the unrealistic expectations of massive sales goals through focus on existing customers, incorporating their feedback and focusing on retention and lowering churn rates. There is also an increasing number of VCs which focus on bootstrapped start-ups. These “Rational VCs” search for both growth and profitability. Some examples of VCs include Interinvest, Volta Ventures, Reflexion Capital or Liberset.

Female founders

In the VC space, there is rising talk about gender equality when it comes to founder teams and VC-backed startups.

There are some interesting trends and numbers when we observe the German startup space. The share of female founders in Germany has risen to 20% and 37% of founding teams currently include at least one woman – but they remain significantly underrepresented. When observing newly founded startups, the share of female founders is at 40%. Therefore, we can expect the trend in absolute numbers to come closer to a 50:50 split in the next years. Female founder teams can be an appealing target for VCs since these teams have a stronger focus on sustainability as part of their corporate strategy, offering strong growth opportunities.

Where the gender gap is even more significant is in terms of financing and growth, with male teams receiving almost nine times as much capital on average as female teams. To read more about female entrepreneurship and the female startup scene in Germany, we can recommend the Female Founders Monitor published by Startup-Verband.

The year 2022 has really seen many ups and downs in the four focus areas of us at neosfer. But despite some negative developments, we see a positive trend in many innovation topics. Since we want to contribute to these positive developments and news in 2023 as well, we are already busy preparing for the new year. You can expect many exciting blog articles, Talks Between the Towers, LinkedIn posts, newsletters and of course a brand-new IMPACT FESTIVAL. We want to improve the way we live, work and communicate with each other and accelerate digital and sustainable transformation. And we will continue to do so in 2023!

neosfer GmbH

Eschersheimer Landstr 6

60322 Frankfurt am Main

Teil der Commerzbank Gruppe

+49 69 71 91 38 7 – 0 info@neosfer.de presse@neosfer.de bewerbung@neosfer.de