22min reading time

Blockchain & energy consumption - what’s the problem actually?

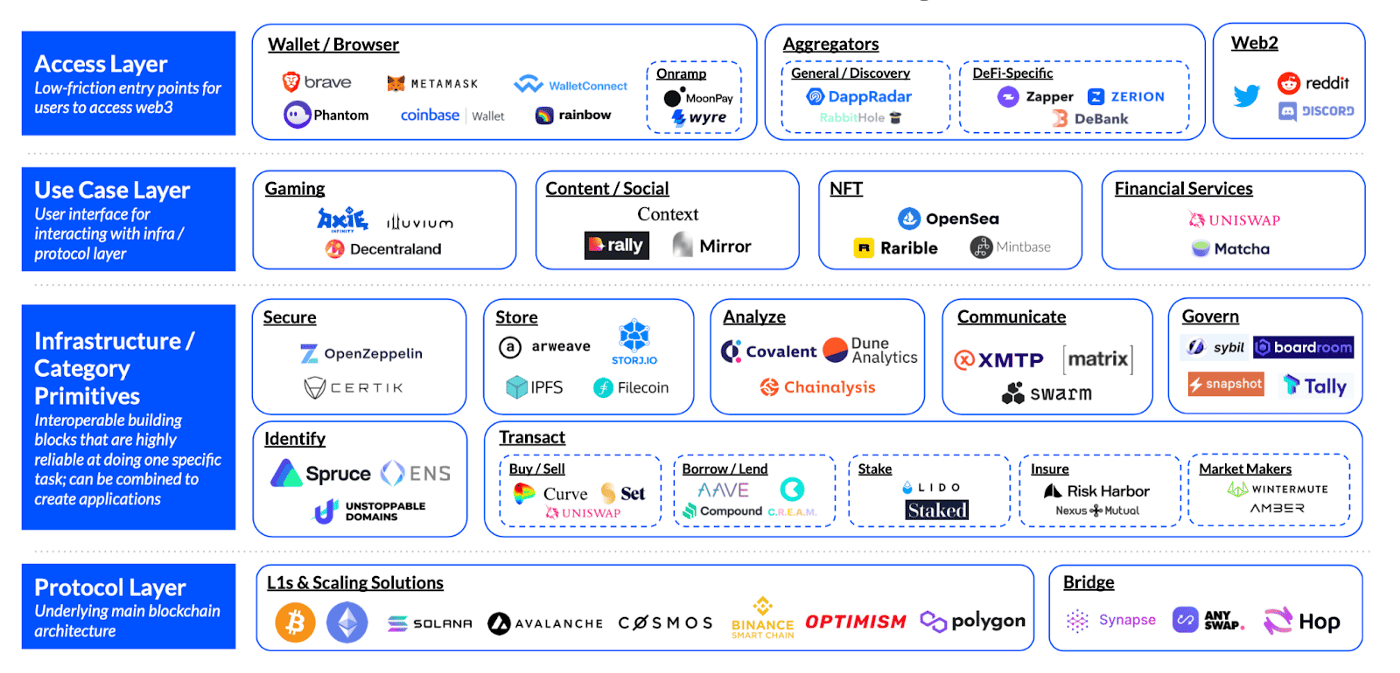

Background: the necessary tech stack of web 3.0

Protocol Layer

Infrastructure Layer

Use case Layer

Access Layer

Der energieintensive Protocol Layer

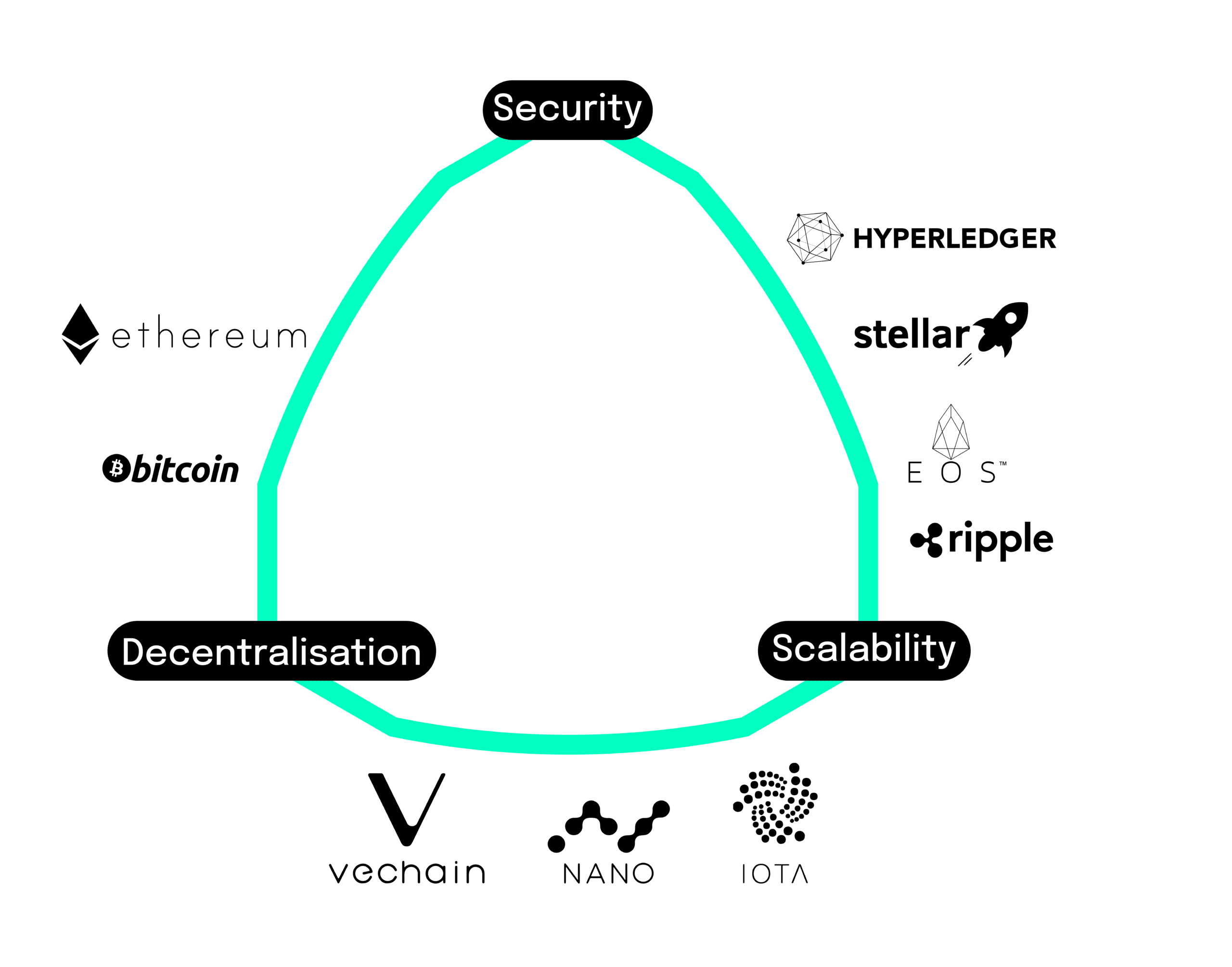

However, all blockchains have their limitations. The Blockchain Trilemma summarizes this pretty well. In this graphic, you can see that you can only optimize for two of three properties – scalability, security, and decentralization – but not for all three of them at the same time. If we do not optimize for scalability in a Web 3.0 setting, why should an application get any adoption that classic Web 2.0 use cases already have?

Just for comparison: Bitcoin’s decentralized design processes 4.6 transactions per second, and the current Ethereum mainnet can process just 15 transactions per second. Visa meanwhile does around 1,700 transactions per second on average. Ethereum (which serves as the foundation for many dApps) may reach its limits at times, resulting in long waiting times and/or high transaction fees. In crypto jargon, these fees are called “gas fees” and are used to compensate Ethereum miners for verifying transactions on the blockchain. These fees are neither fixed nor are they dependent on the size of an individual transaction, but on how many transactions are being made on the Ethereum network at any given moment.

During busy periods with high demand, gas fee prices might surge, which was the case recently during the much anticipated launch of “Otherside”, the virtual world of the blue-chip Bored Apes NFT collection by Yuga Labs. When a user wanted to purchase virtual land (called “Otherdeed”) in Otherside, he/she paid for the digital asset in Bored Apes’ native currency, ApeCoin. The gas fees meanwhile still had to be paid in ether (Ethereum’s native currency). Since many people wanted to mint their piece of land quickly and at the same time, gas prices surged to over $5,000 CoinTelegraph reported, with peaks as high as $14,000.

Ethereum is very aware of its shortcomings and has already stated its vision to solve this problem. In 2020 Ethereum announced that it wanted to move to a proof-of-stake consensus mechanism (we’ll cover the different consensus mechanisms in more detail in the next section) and launched the Beacon Chain that is running alongside the original PoW system. The merge between the Ethereum mainnet and the proof-of-stake successor “Beacon” is scheduled for the third quarter of 2022. The network also plans to include sharding as part of Ethereum 2.0 as a solution to solve the above-mentioned trilemma and increase the chain’s security and scalability. The new system will accomplish this by breaking data verification tasks up among sets of nodes, and each will be responsible for verifying only the data it has received. As the new verification process will be reliant on the storage capacity of the individual user, the process would be less dependent on the energy-intensive computational power of personal computers.

Due to the limitations of the original layer 1 protocol networks like Ethereum and Bitcoin, other blockchains emerged like Binance Smart Chain, Solana, Algorand, Cardano or Terra. Solana, for instance, can process up to 50,000 transactions per second, with an average transaction cost of only €0.00023 by using a combination of proof-of-stake and proof-of-history consensus mechanism (we’ll explain and discuss different consensus mechanisms in the next section). Although Solana is often titled as the fastest blockchain, it has major problems in terms of reliability. Likewise, at the time of writing this article (10 May 2022) Solana recently crashed for the seventh time in the last few months and was down for multiple hours.

At the same time layer 2 networks and protocols are being developed like Polygon, Ronin, Aztec, Metis Network, Loopring, Optimism, etc. to alleviate capacity limitations. They are often called “rollups”. These layer 2 scaling protocols are built on top of Ethereum or other layer 1 blockchains. They are based on the initial infrastructure, but do not send information and transactions directly to it. Layer 2 is a collective term for solutions designed to help scale applications by handling transactions off the Ethereum Mainnet (layer 1) while taking advantage of the robust decentralized security model of Mainnet. Polygon has a capacity of around 7,000 possible transactions per second, the average cost is just between 0.1 and 0.5€ To connect the two layers, Web 3.0 needs so-called “bridges” like Polkadot, Binance Bridge, Celer cBridge or Wormhole. These cross-chain bridges serve as direct crossroads that let users move value (digital assets, crypto currencies) from one chain to another.

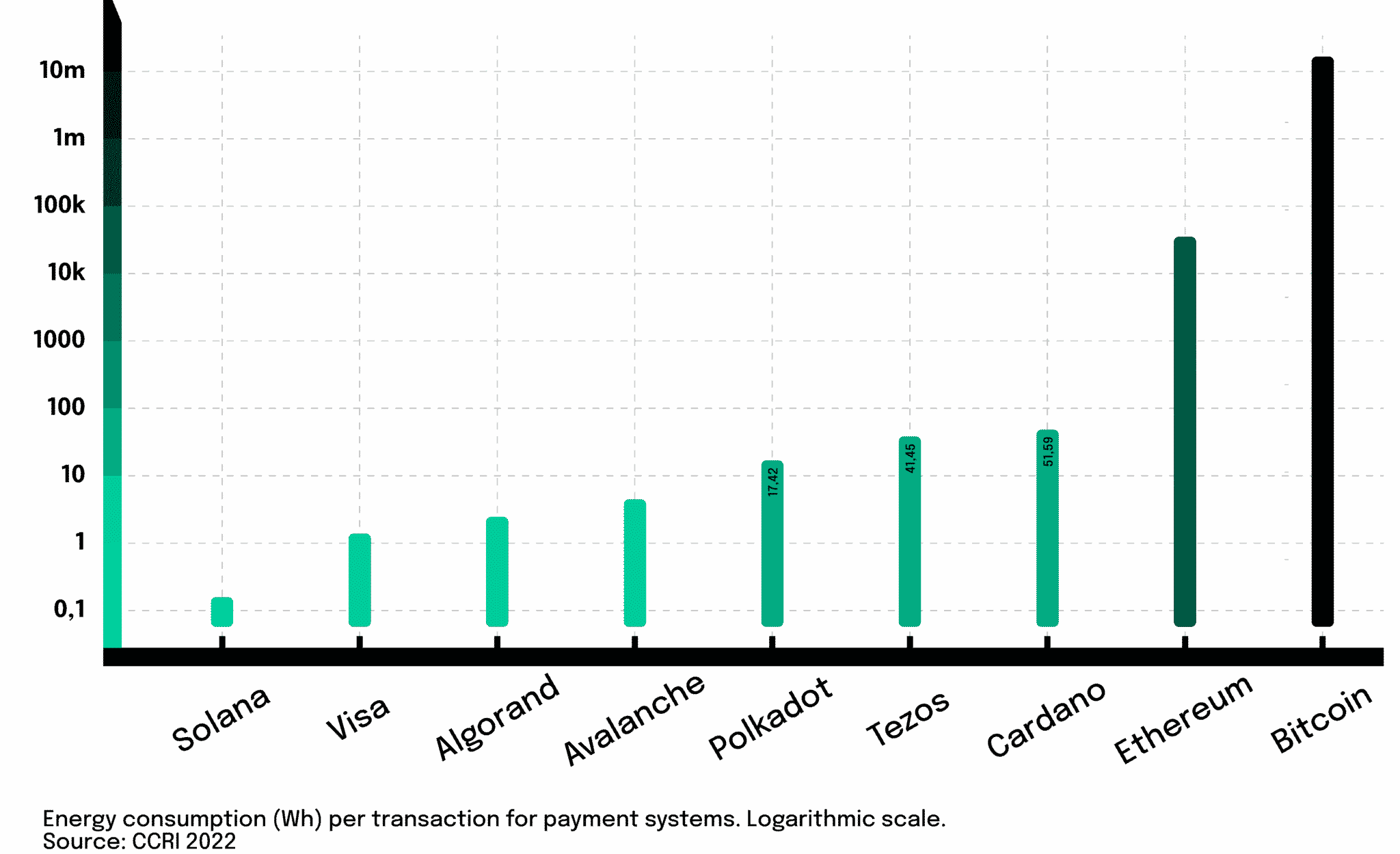

If we have a look at the energy consumption of different blockchains, it becomes obvious that Bitcoin and Ethereum are the largest consumers and have a problem, as indicated by the Crypto Carbon Ratings Institute Report 2022.

Consensus mechanisms and their respective sustainability

Proof-of-Work

The proof-of-work mechanism is based on complex search puzzles that require large amounts of tries to be solved by so-called “miners” who validate the transactions. This process is commonly referred to as mining because the energy and resources required to complete the puzzle are often considered the digital equivalent to the real-world process of mining precious metals from the earth. In such a system, participating computer nodes compete against each other to generate cryptographic hashes that satisfy a network-determined level of complexity. To maintain security, that complexity level is kept high enough that it would deter anyone from attacking the network.

Nathaniel Popper put it straightforward in his book “Digital Gold”: “It is relatively easy to multiply 2,903 and 3,571 using a piece of paper and pencil, but much harder to figure out what two numbers can be multiplied together to get 10,366,613.” A miner in the Bitcoin network must figure out which two numbers can be multiplied to reach 10,366,613 by essentially guessing. Once a computer determines that 2,903 can be multiplied by 3,571 to make 10,366,613, the computer presents the solution to the other computers in the network, which will verify the result. The miner who first gets the right solution is awarded with native coins of the corresponding blockchain (e.g. Bitcoin or Ether).

To solve as many search puzzles as quickly as possible and due to the rising popularity and value of cryptocurrencies like Bitcoin, large mining farms have been set up in countries with low energy prices like Kosovo, Norway or China. But of course, this process is very energy intensive which is why countries like Kosovo, riddled by an energy crisis, seized and banned mining farms to guarantee access to energy for the national population.

Nonetheless, the high-energy consumption of PoW blockchains is to some extent a design feature, since it prevents them from being attacked. An attacker must use at least 25 to 50 percent of the total computing power that participating miners use for mining to be able to successfully manipulate or control the system.

Proof-of-Stake

Whereas in the proof-of-work system it is a race to be first, this is different In the proof-of-stake system. The validators are chosen to find a block based on the number of tokens they hold or by a previously set algorithm that is awarded to validate the next transaction, rather than having an arbitrary competition between miners. An algorithm regularly (e.g., every 10s) pseudo-randomly selects a validator and assigns them the right to create the next block, which points to a previous block.

In this system, the quantity of crypto a user holds, replaces the work miners do in proof-of-work. Likewise, there are no “miners” or “mining” in the proof-of-stake language, there this process is referred to as “staking”. This structure secures the network because a potential participant must purchase the cryptocurrency and hold it to be picked to form a block and earn rewards. Nonetheless, there are also some disadvantages regarding proof.of-stake, too: One might be a 51% attack. If someone controls 51% of the coins on a blockchain and uses that majority to alter the blockchain. A second example is “stake grinding” which refers to the circumstance that a validator performs computations or other steps to bias the randomness of the next chosen validator in their favor. There are on the one hand arguments that getting rid of PoW’s energy consumption comes at the price of security because one can only accrue voting weight (capital) from inside the system. On the other hand, it can also be argued that PoS has less of a tendency to centralize due to PoW’s/mining’s economies of scale and is more secure eventually.

Pledges for sustainable improvements

Blockchain providers are hearing the call and start to transform. The Crypto Climate Accord for example pledges to decarbonize the global crypto industry by prioritizing climate stewardship and supporting the entire crypto industry’s transition to net-zero greenhouse gas emissions by 2040. There are also big corporations working on solutions like Blockstream together with Tesla and Block (formerly Square) which announced plans to build a solar-powered mining center that is sustainable. There are other energy-efficient blockchains emerging like Cardano, Tezos and KodaDot. As already mentioned, Ethereum for instance is changing its consensus mechanism from PoW to PoS. According to the organization, this will decrease energy usage by ~99.95%. Algorand in cooperation with ClimateTrade pledged to be the greenest blockchain and be carbon neutral (using a consensus mechanism named Pure PoS) and Polygon for its part announced to go carbon negative in 2022 with a $20 Million Pledge. We expect proof-of-stake to be the standard for consensus mechanisms regarding the high-energy consumption of proof-of-work. At the same time, it has to be emphasized that the energy mix is also very relevant for the judgment of blockchains. Many projects are already switching towards using renewable resources like solar, wind and water. Occasionally, however, this leads to negative, unintended impacts for the local population. In some countries like China, for instance, this might lead to problems in terms of water usage and availability for regular people.

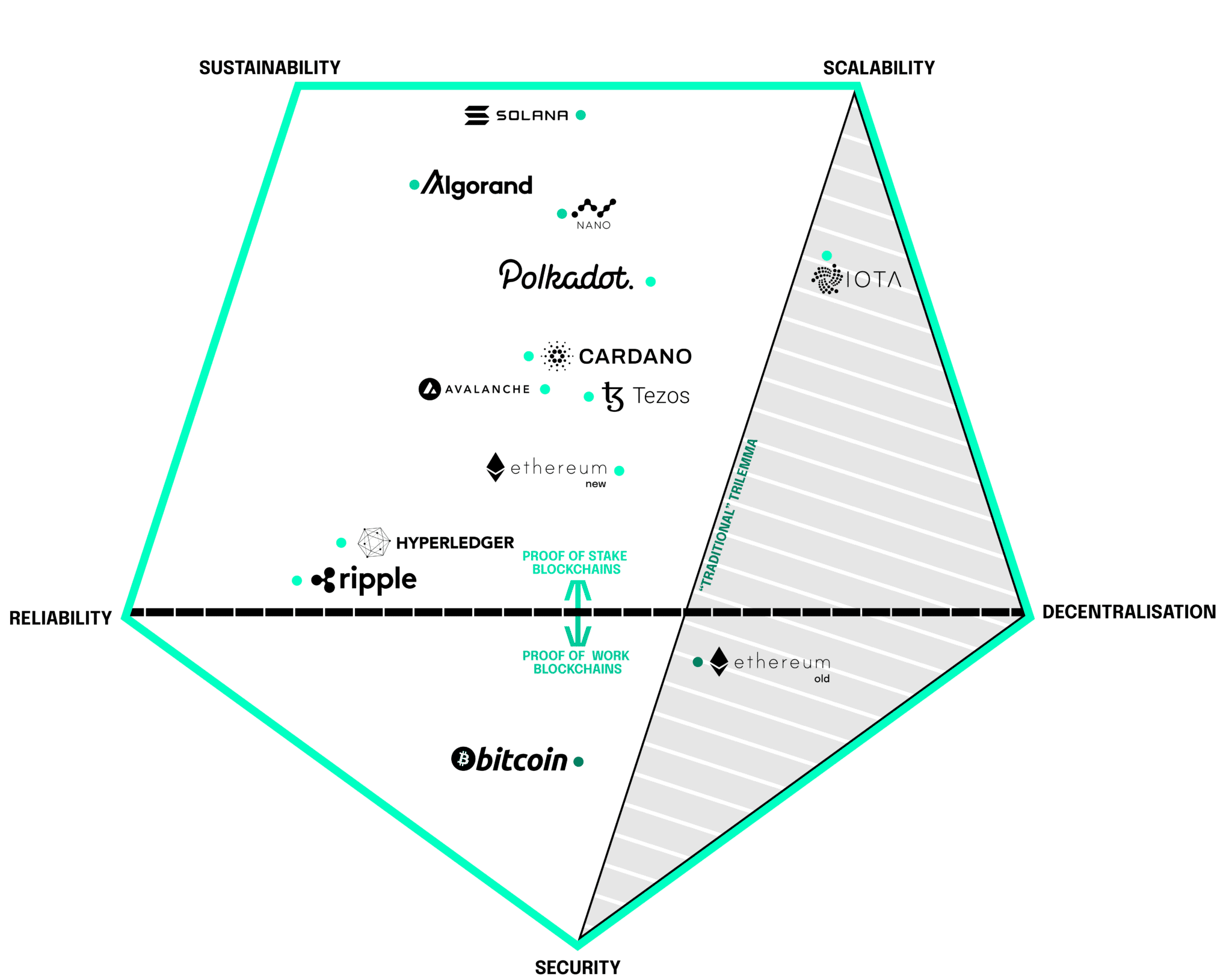

To sum these first thoughts up, we think that in future you can’t judge blockchains in the “old” trilemma thinking only (neither is a quadrilemma approach sufficient). We are convinced that in the future, you have to add two important dimensions – reliability and sustainability. Likewise, we think more of a pentalemma, which looks something like this with some blockchains as indications:

Transforming power of the blockchain

Blockchain in itself may not only be a problem, but can also help to accelerate the sustainable transformation. Distributed ledger technologies can for instance be beneficial to manage the data that underpin distributed clean energy infrastructures like Smart Grids. Blockchain can also address the challenge of managing distributed energy value chains, from the generation of electricity, to distribution, to final consumption and unlock new mechanisms to catalyze green finance (including clean energy financing). Some potential use cases for the utilization of blockchain technologies may be a) peer-to-peer energy trading, b) market platforms for renewable energy certificates, c) micro-leasing marketplace, d) the trading of carbon offset credits and e) digital measurement, reporting and verification (MRV). Many of these solutions combine different state-of-the-art technologies like blockchain, artificial intelligence and the Internet of Things (e.g., smart meters), alongside affordable renewable energy production (e.g., rooftop solar panels) and storage equipment (e.g., batteries).

Before focusing on some of these use cases, we have to take a step back and have a look at so-called “oracles”. Of course, it sounds great that you can implement different use cases on the blockchain, but how do you actually get data from the “real world” onto the blockchain? This is where oracles come into play. An oracle serves as a connection between a blockchain like Ethereum, Polygon, Solana, etc. and data/information from the real world like weather reports, humidity, status of machines, etc. The data is often collected via sensors and an oracle then acts as an on-chain API that you can query to get information into your smart contracts. You can also use oracles the other way around, which means that you can also send data to applications in the real world. Nonetheless, there arises one big “oracle problem”. The quality of the results you process by using a blockchain, of course, depends on the quality of the data you feed onto the blockchain via oracles. Likewise, you always have to question where the data comes from, and additionally it is recommended to use multiple data sources, also regarding security aspects.

Smart Grid

The term refers to the transition of entities into becoming simultaneously producers and consumers and at the same time utilizing many smaller renewable energy producers, and essentially pushing the prosumer economy. As the demand for decarbonization of a conventional energy system increases, blockchain offers peer-to-peer energy exchanges within microgrids as a way to redesign our cities’ energy metabolism (Wainstein, 2019). The usage of the Blockchain Distributed Energy Network (BDEN) may lead to gains in transparency, competition, cost savings and efficiency.

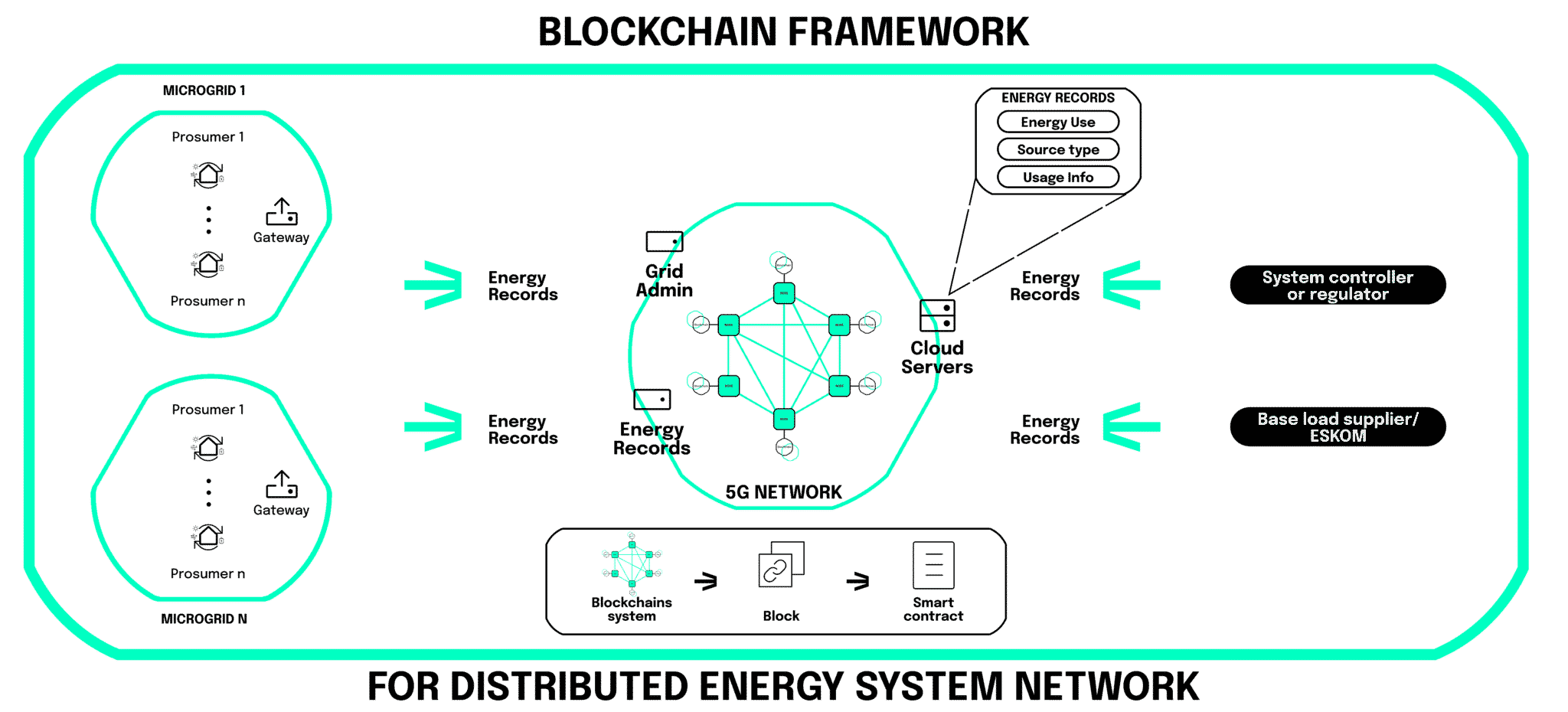

From the energy sector perspective, blockchain technology provides an answer to security issues associated with the energy supply chain, following the route from its generation to consumption. The above figure proposes a BDEN framework that keeps the data private while allowing the participants of the microgrid to benefit from immutability and traceability (Dzobo et al., 2021). The idea behind the illustrated BDEN model suggests the prosumer energy records from each microgrid would be stored in a cloud server, where each participant will be classified based on their area and the assigned personal ID. The main benefit of such a blockchain-powered model is a private microgrid, locally managed by its prosumers, all while ensuring two-way data flow.

Additionally, to the promotion of local energy production, which in turn reduces large-scale energy losses, blockchain’s traceability allows energy consumers to reflect on their own ecological footprint. By having more visible control over their energy distribution, households will have a stronger incentive to ration their consumption, thus optimizing collective usage of sustainably generated energy. Setting up a network connecting distributed energy resources (DERs) with consumers’ homes and appliances could significantly improve the current environmental state that requires the promotion of local renewables-based energy production.

Sustainable Supply Chain Management (SSCM)

Defined by the UN, supply chain sustainability is the management of environmental, social, and economic impacts, and the encouragement of good governance practices throughout the entire life cycle of a good or service. Blockchain is an opportunity for often outdated systems, as it enables all the actors of the supply chain to register their activities in one intact record. The negative environmental impact of supply chains has been acknowledged for years. In 2016, it was reported that supply chains of companies packaging consumer goods (CPG) were responsible for up to 90%of the environmental damage (McKinsey, 2016). This estimation starkly overweighs the impact caused by all other forms of business operations.

Key actors in the raw materials industry are trying to tackle supply chain issues by implementing more sustainability-focused solutions. For instance, to trace a bag of cobalt, a block of information can be added at each step of the supply chain, through a unique identifier, such as a QR code. Similarly, via a unique label, metals, and minerals can also be traced by using the information about their chemical compounds. Integrating blockchain into sustainable supply chain management (SSCM) also allows for a higher level of consumer awareness. Is this new pair of sneakers you purchased authentic? Could the food you consumed have been possibly contaminated with bacteria? These questions of product integrity stand as valid concerns of a traditional supply chain with its transparency and traceability issues. With blockchain technology in place, a buyer could simply scan the package using their cell phone to retrace the route the product has traveled before reaching the store shelf (Parung, 2019). Consumers will then be able to reject a product in case of doubts about sustainability, as their decisions will be more informed.

Trading of carbon credits

Other examples of the intermerging web 3.0 & sustainability landscape

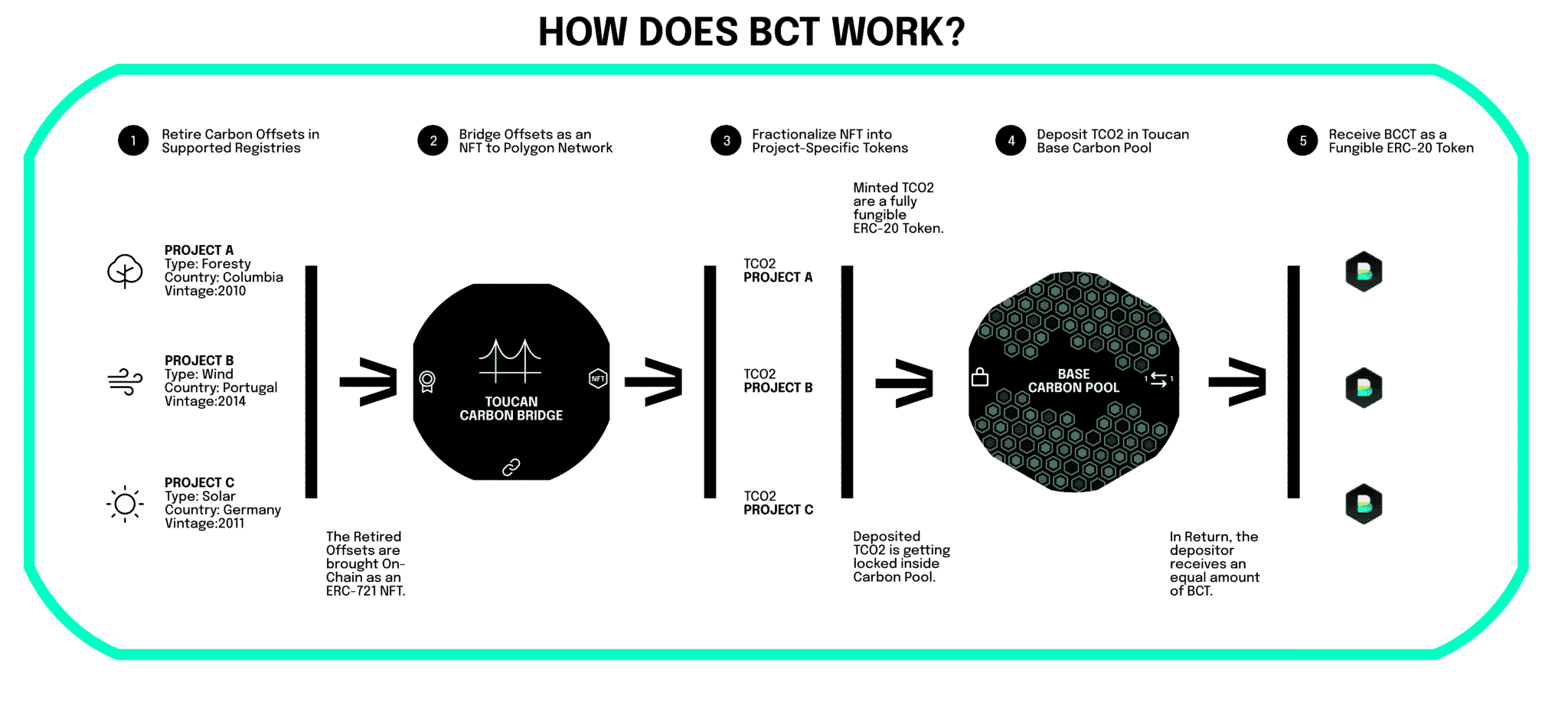

- Klima DAO aims to provide liquidity to the carbon market. It works closely with Toucan and is using the Toucan Carbon Bridge to allow users to convert their BCTs directly into KLIMA tokens.

- The DAO Regen Network provides means to track soil regeneration efforts on the blockchain.

- The Brooklyn Microgrid uses blockchain technology to create a power grid for Brooklyn residents to sell excess solar energy to other New York City residents.

- Smart token contracts have allowed charitable institutions to raise funds in a new way, like the World of Waves (WOW) token. Its mission is to restore the planet’s oceans and combat climate change.

- Solarcoin is a startup that distributes tokens as a reward to people who install solar arrays in their homes or businesses.

- Art project terra0 has minted a so-called “two degrees NFT” which will get burnt as soon as the average annual temperature rise surpasses two degrees celsius.

- The Powerledger platform facilitates peer-to-peer energy trading and helps producers track, trace, and trade energy in real-time, enabling more stable, resilient energy grids.

- SEEDS is a cryptocurrency that tries to align money with environmental value

- Nemus is a collectible NFT designed to conserve & protect the Amazon Rainforest

- The Crypto Climate Coalition by insurance company Lemonade offers insurance to small farmers by accurately quantifying weather risks.

- WWF has launched Non-Fungible Animals (NFA), a collection of NFTs inspired by ten endangered species. The proceeds from the sale of the NFAs will go towards the conservation of endangered species.

Amenta, C., Riva Sanseverino, E. & Stagnaro, C. (2021). Regulating blockchain for sustainability? The critical relationship between digital innovation, regulation, and electricity governance. Energy Research & Social Science, 76, 102060.

https://doi.org/10.1016/j.erss.2021.102060

Bai, C. & Sarkis, J. (2020). A supply chain transparency and sustainability technology appraisal model for blockchain technology. International Journal of Production Research, 58(7), 2142–2162. https://doi.org/10.1080/00207543.2019.1708989

Binder, M. (2022, 2. Mai). Bored Ape Yacht Club caused Ethereum fees to soar to astronomical levels. Mashable. Abgerufen am 20. Mai 2022, von https://mashable.com/article/ethereum-gas-fees-skyrocket-bored-ape-yacht-club-otherside-nft-launch

BMUV. (2022, 1. Januar). Sprint-for-Green. Abgerufen am 23. Mai 2022, von https://www.bmuv.de/digitalagenda/produktpass/pkw-batterie

Chainlink. (2022, 24. Mai). New Report: Blockchains and Oracles Are Redefining the Energy Industry. Chainlink Blog. Abgerufen am 27. Mai 2022, von https://blog.chain.link/blockchains-and-oracles-are-redefining-the-energy-industry/

Coinbase. (2022, 15. Januar). A simple guide to the Web3 stack – The Coinbase Blog. Medium. Abgerufen am 8. Mai 2022, von https://blog.coinbase.com/a-simple-guide-to-the-web3-stack-785240e557f0

Ethereum. (2022, 27. Mai). Ethereum upgrades (formerly ’Eth2’). Ethereum.Org. Abgerufen am 27. Mai 2022, von https://ethereum.org/en/upgrades/

Figueiredo, K., Hammad, A. W., Haddad, A. & Tam, V. W. (2022). Assessing the usability of blockchain for sustainability: Extending key themes to the construction industry. Journal of Cleaner Production, 343, 131047. https://doi.org/10.1016/j.jclepro.2022.131047

Friedman, N. & Ormiston, J. (2022). Blockchain as a sustainability-oriented innovation?: Opportunities for and resistance to Blockchain technology as a driver of sustainability in global food supply chains. Technological Forecasting and Social Change, 175, 121403. https://doi.org/10.1016/j.techfore.2021.121403

Gemini. (2022, 5. März). Blockchain Trilemma: Scaling and Security Issues. Abgerufen am 14. Mai 2022, von https://www.gemini.com/cryptopedia/blockchain-trilemma-decentralization-scalability-definition

Mcshane, G. (2022, 11. Januar). What are Gas Fees? CoinDesk. Abgerufen am 11. Mai 2022, von https://www.coindesk.com/learn/what-are-ethereum-gas-fees/

Parmentola, A., Petrillo, A., Tutore, I. & de Felice, F. (2021). Is blockchain able to enhance environmental sustainability? A systematic review and research agenda from the perspective of Sustainable Development Goals (SDGs). Business Strategy and the Environment, 31(1), 194–217. https://doi.org/10.1002/bse.2882

Pizzi, S., Caputo, A., Venturelli, A. & Caputo, F. (2022). Embedding and managing blockchain in sustainability reporting: a practical framework. Sustainability Accounting, Management and Policy Journal, 13(3), 545–567. https://doi.org/10.1108/sampj-07-2021-0288

Ronaghi, M. H. & Mosakhani, M. (2021). The effects of blockchain technology adoption on business ethics and social sustainability: evidence from the Middle East. Environment, Development and Sustainability, 24(5), 6834–6859. https://doi.org/10.1007/s10668-021-01729-x

Schinckus, C. (2020). The good, the bad and the ugly: An overview of the sustainability of blockchain technology. Energy Research & Social Science, 69, 101614. https://doi.org/10.1016/j.erss.2020.101614

- Geschäftsführer neosfer

Lorem ipsum dolor sit amet, consetetur sadipscing elitr, sed diam nonumy eirmod tempor invidunt ut labore et dolore magna aliquyam erat, sed diam voluptua. At vero eos et accusam et justo duo dolores et ea rebum. Stet clita kasd gubergren, no sea takimata sanctus est Lorem ipsum dolor sit amet. Lorem ipsum dolor sit amet,

These might interesst you

Further News

neosfer GmbH

Eschersheimer Landstr 6

60322 Frankfurt am Main

Teil der Commerzbank Gruppe

+49 69 71 91 38 7 – 0 info@neosfer.de presse@neosfer.de bewerbung@neosfer.de