Earning money and doing good. Can this succeed with ESG and impact investing?

15min reading time

In our last article, we recognized that a lot has changed here in recent years. Agenda 2030 and the Paris Climate Agreement have brought the concept of sustainability to the center of society. Conversely, this has of course also had an impact on the financial industry. EU-wide regulations significantly increased the pressure on the private financial sector to drive the sustainable transformation of the industry. However, the financial industry has long recognized this responsibility for sustainable transformation. Thus, in recent years, in parallel with new regulations, private sector practices have also emerged that have sustainable investing as a goal and have defined the private sustainable finance landscape.

Society as a whole also views financial institutions in a critical light. In virtually all areas of life, we are putting pressure on companies to make more sustainable decisions and operate more sustainably, and our purchasing and consumption behavior is constantly changing. In relation to the financial industry, this increased pressure for greater sustainability can be seen as one of the means by which society can express its desire for more sustainable investments. Financial institutions, in turn, are responsible for recognizing this need by creating sustainable investment opportunities and aligning their investment policies with overall sustainability criteria.

Status quo of sustainable finance

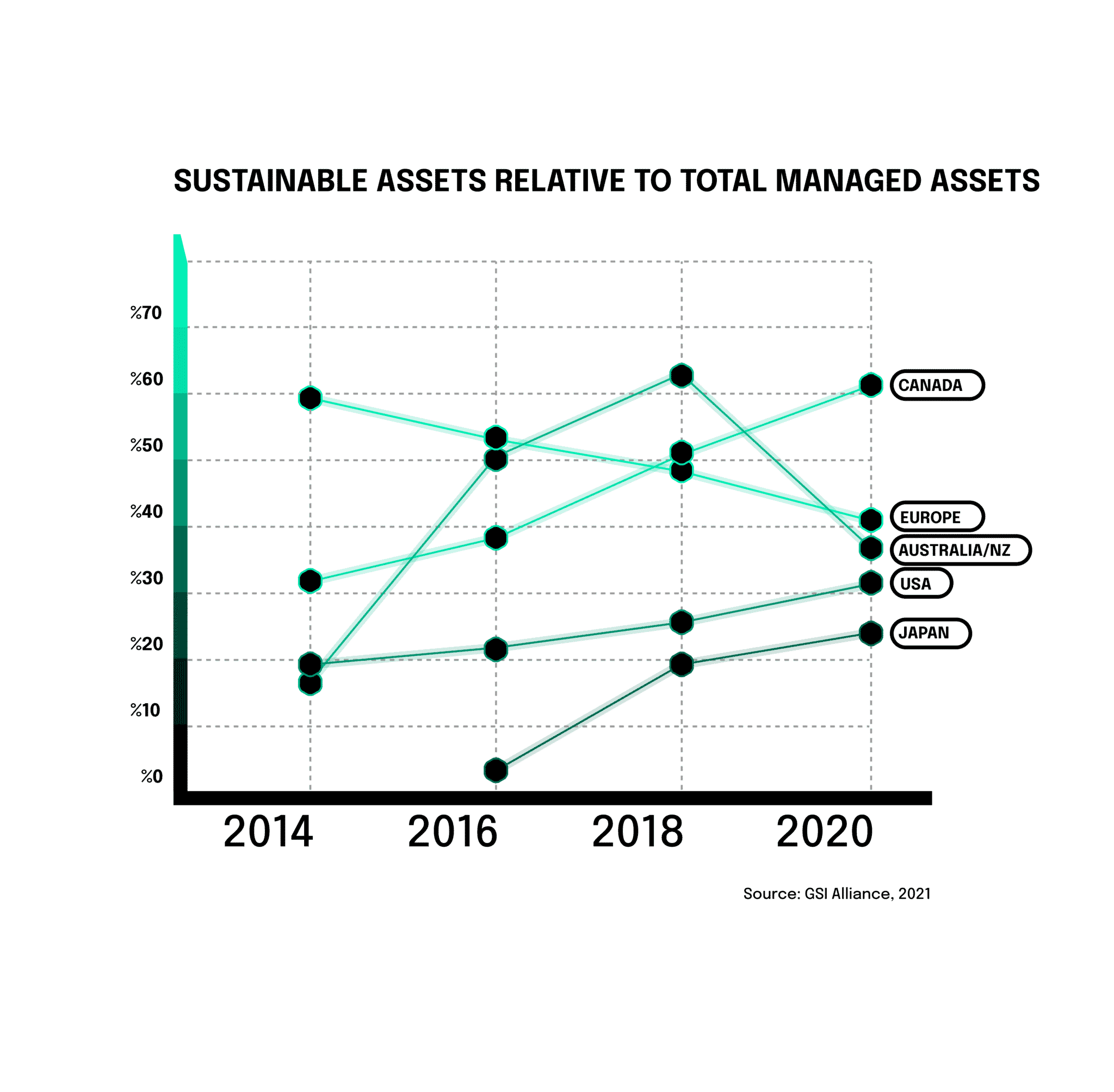

Thus, the assets that are defined as sustainable investments have grown significantly in recent years. Are new EU regulations or more sustainable investment guidelines then necessary at all? Apparently so, because what can also be observed, however, is a declining relative sum of sustainable investments compared to all investments in Europe. This is exactly where the EU comes in with the taxonomy, the CFDR and the SFDR to reverse this negative trend. Want to learn more about the latest financial regulations?

Then here’s our article that gives you an overview of the EU regulatory landscape!

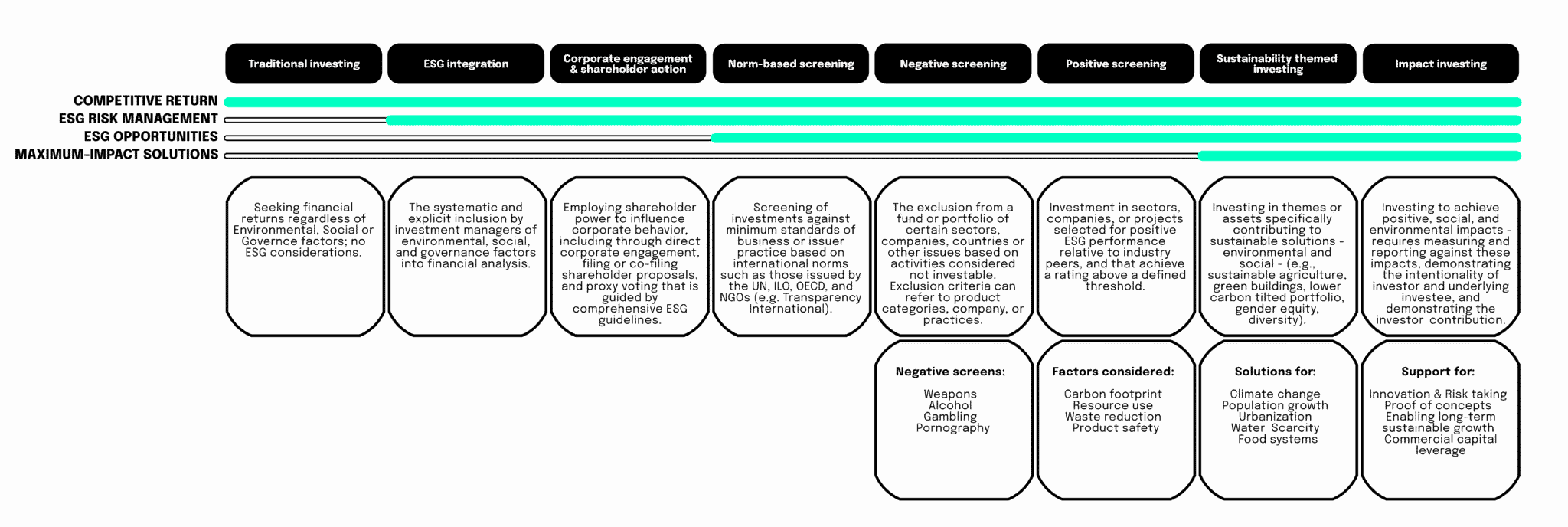

There is a lot of momentum not only in the amount of sustainable assets and EU regulations! In addition to traditional investing, seven sustainable investment strategies have emerged in the private finance industry. These are ESG integration, followed by negative screening, corporate engagement and shareholder action, standards-based screening, positive screening and sustainability-focused investing, and impact investing. All of these strategies share the common goal of investing in sustainable projects and enabling retail investors, investors and companies to meet ESG criteria and contribute to the achievement of the SDGs and the EU Green Deal.

What unites all strategies is the possibility of achieving competitive returns. In the other three points ESG Risk Management, ESG Opportunities and Maximum Impact Solutions, the differences between the various strategies become clear. We show definitions, similarities and differences in more detail in the chart below.

The impact of ESG investments

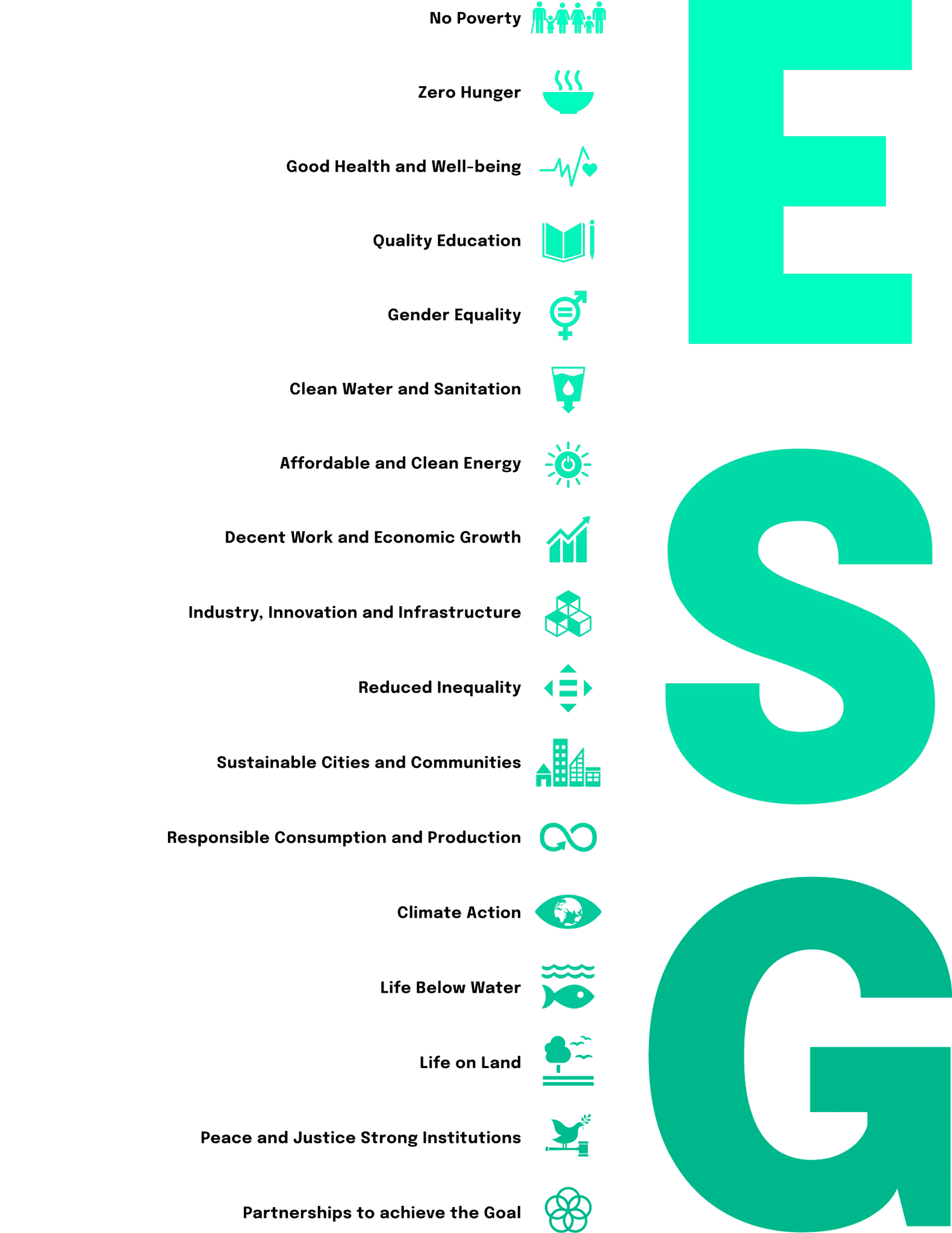

If an asset is labeled as sustainable, the additional investment criteria are often summarized under the acronym “ESG”, thus the name of the investment strategy is also created. This acronym stands for the financial market-relevant sustainability aspects of environmental, social and governance. Furthermore, investments are also referred to as sustainable if they are launched in accordance with global legal standards of the Agenda 2030 or the Paris Climate Agreement, or if they invest specifically in sustainable areas such as renewable energies. A more precise classification of sustainable investments can also be found in the EU Taxonomy, which plays a central role in the sustainable transformation of the EU-wide financial industry.

An important step in understanding how ESG investments can promote greater sustainability is to link the SDGs to the ESG criteria. With the chart below, we not only show what ESG actually means in detail, but we also link the criteria to the SDGs defined in the 2030 Agenda. Thanks to this link, investors and financial institutions can identify sustainable projects, keep up with the latest regulatory requirements, and provide financing for the European Green Deal.

ESG investing as a performance booster

The potential performance of ESG investment strategies

ESG investing compared to other investment strategies

Why is ESG investing so interesting for VCs?

With the findings just described, some derivations for venture capital investors (VCs) can be derived. Thus, a VC does not necessarily have to limit itself from the outset to the companies with the lowest ESG risks or invest only in companies with very high ESG compliance. Because VC investors particular have greater influence over the governance, management and operations of the invested company, they can turn companies into ESG improvers and generate significant returns. If they can steer the company toward a future aligned with ESG criteria, the company has a chance to beat the market, bring in a higher ROI, and minimize ESG-related business risks.

All of this sounds flawless so far. But we don’t want to dismiss the negative sides of ESG investing for that very reason. We therefore highlight a key problem with ESG scores in our next section.

The core problem of ESG ratings

So how exactly are the ESG ratings mentioned above provided and calculated by rating agencies like MSCI and Sustainalytics? Contrary to what many people think, most ratings have nothing to do with actual corporate responsibility, which usually relates to ESG factors.

Instead, they measure the degree to which a company’s economic value is at risk due to ESG factors. For example, a company could be a significant source of emissions but still receive a decent ESG rating if the rating agency believes the environmentally harmful behavior is well managed or does not jeopardize the company’s financial value.

So if companies are hedged against these risks, they can still get a good ESG score from one of the rating agencies. This is one of the reasons why major oil companies like Exxon and BP still have a good ESG rating. Further, the rating agencies consider the future aspirations of the companies to do good. When Philip Morris stated that they were committed to a smoke-free future, their ESG rating was raised significantly. Rating agencies might perceive this statement as a (future) reduction in regulatory risk, even though the next generation of products continues to be addictive and, of course, harmful to society and individuals.

So, we clearly see that ESG investing and ESG ratings are not free of problems. There are opportunities for improving ESG investment strategy that need to be exploited to make the financial industry more sustainable. It is a good start that ESG investing is financially viable, but investors have more transparent information available about a company’s sustainability to increase the impact of their sustainability-focused investments. VCs in particular can take responsibility here and have a significant impact on the sustainable transformation of the financial industry.

However, the innovative power of the financial industry does not end with the first six sustainable investment strategies and specifically investing according to ESG criteria. We also kept talking about impact in this article and have defined impact investing as the seventh sustainable investment strategy.

How does impact investing enter the scene?

Why exactly is impact investing a seventh and meaningful sustainable investment strategy? And what are the characteristics of this strategy that make it different from the other investment strategies? Impact investing comes into play to focus even more on corporate social responsibility and to expand ESG criteria. To understand the basic idea, it is necessary to point out the difference between impact investing and ESG investing.

The main difference between ESG and impact investing is that impact investing is much more focused on the positive social and environmental outcomes of the investment object. As a result, there is a greater focus on corporate social responsibility and the company is viewed as a corporate citizen. The basic idea is that the sustainable development of our society requires a social, economic and environmental bottom line. ESG investing with its criteria focuses more on immediate financial returns and assessing risks related to ESG criteria. Impact investing focuses on the immediate impact of the investment project on ESG criteria for society.

Therefore, impact investing is characterized by a direct link between these value- and ethics-based priorities and the deployment of investor:s capital and influence. It ultimately places more social responsibility on investor:s and underscores the importance of corporate social responsibility. Investor:s are not only required to report on financial returns, but also generate measurable KPIs that track the positive social impact of the investment and quantify impact. Thus, this investment strategy represents a new level of responsibility for financial institutions.

By focusing on ethical and value-based investment criteria, long-term financial returns can be realized as the companies invested in operate a more sustainable business, including financially. They do not encounter corporate problems of lack of diversity, poor social responsibility or greenwashing. As a result, these companies can avoid many scandals and future problems, which can have a positive long-term impact on return on investment (ROI). The positive external effect of the investment objects is, in turn, naturally also transferred to the investors and, rightly so, allows them to appear in a sustainable spotlight.

Can ESG and impact investing be combined?

Is there an opportunity for VC investors with a current ESG investing focus to take additional steps towards impact investing? How can VCs adopt this sustainable strategy without disrupting their current business model? Let’s explain four different strategies for adopting a stronger impact focus in strategic investment decisions. All of these strategies do not imply a total transformation of underlying investment strategies, but they can be seen as a first entry point to a stronger focus on impact investing.

Dedicated impact employees

Having dedicated impact staff on a VC’s team can significantly reduce the risk of misunderstanding and inaccurate analysis. Furthermore, these employees will act as an anchor point to keep the VC’s management in check when it comes to steering the company’s sustainable direction.

SDGs as a risk framework

Each SDG represents a pressing sustainability issue. These issues can change the systematic risk of an investment property, which should be considered when making investment decisions. By understanding all the risks in the context of the SDGs, VCs can make more profitable decisions. Thanks to the consideration of these SDG-related risks, the investment team can manage to assess the systematic risk of a potential investment differently, which in turn can influence the required ROI. Thus, the VC can still select investment objects according to ESG criteria, but re-evaluate them by looking at the SDGs.

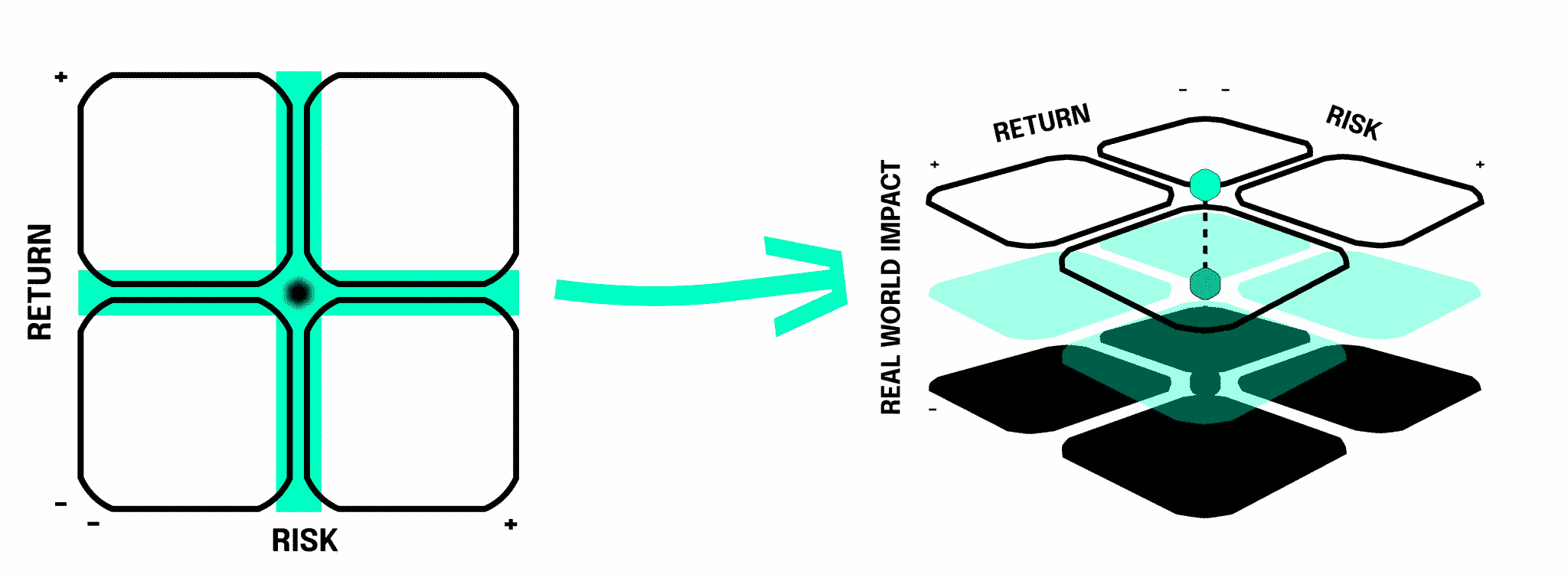

ESG-guided impact analysis

In order to meet the conditions for sustainable investment aligned with ESG criteria, VCs should not only find out how ESG risks and opportunities affect the risk-return profile of an investment portfolio, but also how a responsible investment portfolio affects generating broader societal impact. Therefore, a third axis called “Real-World Impact” can be added to the typical risk-return diagram. By including this third axis, VCs can make more sustainable investment decisions without compromising financial returns.

SDGs as a guideline for capital allocation

If venture capital firms closely follow the trends in the various SDGs, new investment opportunities will open up for them. By keeping up to date with sustainable, technological and overall societal trends and developments, more sustainable business practices, products and services offer new investment opportunities with high growth potential.

If VCs implement ESG criteria and align their investment activities with sustainable development goals and impact investing criteria, significant financial benefits can be realized, but also positive social and environmental change. We clearly show that sustainability and return on investment are not competitors, but can act hand in hand to serve society and benefit VCs and their stakeholders!

Clark, C., Lalit, H. & Rockefeller Asset Management. (2021, 8. Oktober). ESG Improvers: An Alpha Enhancing Factor. Rockefeller Asset Management. Abgerufen am 17. Mai 2022, von https://rcm.rockco.com/insights_item/esg-improvers-an-alpha-enhancing-factor/

Comaroff, J. & Comaroff, J. L. (2002). Privatizing the Millennium: New Protestant Ethics and Spirits of Capitalism In Africa, and elsewhere. Journal for the Study of Religion, 15(2). https://doi.org/10.4314/jsr.v15i2.6126

Egli, F. & Maule, S. (2020, 26. Mai). Missing in Action – The lack of ESG capacity at leading investors. E3G. Abgerufen am 17. Mai 2022, von https://www.e3g.org/publications/missing-in-action-the-lack-of-esg-capacity-at-leading-investors/

Gallardo-Vázquez, D., Barroso-Méndez, M., Pajuelo-Moreno, M. & Sánchez-Meca, J. (2019). Corporate Social Responsibility Disclosure and Performance: A Meta-Analytic Approach. Sustainability, 11(4), 1115. https://doi.org/10.3390/su11041115

Grim, D. M. & Berkowitz, D. B. (2020). ESG, SRI, and Impact Investing: A Primer for Decision-Making. The Journal of Impact and ESG Investing, 1(1), 47–65. https://doi.org/10.3905/jesg.2020.1.1.047

Groß, M. (2011). Handbuch Umweltsoziologie (2011. Aufl.). VS Verlag für Sozialwissenschaften.

GSI Alliance. (2019, 31. Dezember). Global Sustainable Investment Review. GSIA. Abgerufen am 17. Mai 2022, von http://www.gsi-alliance.org/

Khan, M., Serafeim, G. & Yoon, A. (2016). Corporate Sustainability: First Evidence on Materiality. The Accounting Review, 91(6), 1697–1724. https://doi.org/10.2308/accr-51383

López-Arceiz, F. J., Bellostas-Pérezgrueso, A. J. & Moneva, J. M. (2016). Evaluation of the Cultural Environment’s Impact on the Performance of the Socially Responsible Investment Funds. Journal of Business Ethics, 150(1), 259–278. https://doi.org/10.1007/s10551-016-3189-4

Lu, L. W. & Taylor, M. E. (2018). A study of the relationships among environmental performance, environmental disclosure, and financial performance. Asian Review of Accounting, 26(1), 107–130. https://doi.org/10.1108/ara-01-2016-0010

Milante, G. & Jang, S. (2016). Measuring Peacebuilding and Statebuilding in the New SDG Framework. Journal of Peacebuilding & Development, 11(1), 110–119. https://doi.org/10.1080/15423166.2016.1150690

Murray, D., Bilski, B., Verkerk, M., (Ch.), B. H. V. D., Peres, S., der Veer, V. J., Cortese, D. A., Bolkestein, F., Noseworthy, J. H. & Klink, A. (2014). Breakthrough: From Innovation to Impact. The Owls Foundation.

Parker, F. J. (2021). Achieving Goals While Making an Impact: Balancing Financial Goals with Impact Investing. The Journal of Impact and ESG Investing, 1(3), 27–38. https://doi.org/10.3905/jesg.2021.1.014

Puaschunder, J. M. (2016). On the Emergence, Current State and Future Perspectives of Socially Responsible Investment (Sri). SSRN Electronic Journal. https://doi.org/10.2139/ssrn.2720686

Stolz, D. (2013). Nachhaltiges Kalkül. Univ.-Bibliothek Frankfurt am Main.

Taparia, H. (2021, 14. Juli). The World May Be Better Off Without ESG Investing (SSIR). SSIR. Abgerufen am 17. Mai 2022, von https://ssir.org/articles/entry/the_world_may_be_better_off_without_esg_investing

The Global Impact Investing Network. (2017, 17. Mai). Annual Impact Investor Survey 2017. The GIIN. Abgerufen am 17. Mai 2022, von https://thegiin.org/research/publication/annualsurvey2017

Uzsoki, D. (2020, 3. August). Sustainable Investing: Shaping the future of finance. International Institute for Sustainable Development. Abgerufen am 17. Mai 2022, von https://www.iisd.org/publications/report/sustainable-investing-shaping-future-finance

van Duuren, E., Plantinga, A. & Scholtens, B. (2015). ESG Integration and the Investment Management Process: Fundamental Investing Reinvented. Journal of Business Ethics, 138(3), 525–533. https://doi.org/10.1007/s10551-015-2610-8

- Geschäftsführer neosfer

Lorem ipsum dolor sit amet, consetetur sadipscing elitr, sed diam nonumy eirmod tempor invidunt ut labore et dolore magna aliquyam erat, sed diam voluptua. At vero eos et accusam et justo duo dolores et ea rebum. Stet clita kasd gubergren, no sea takimata sanctus est Lorem ipsum dolor sit amet. Lorem ipsum dolor sit amet,

These might interesst you

Further News

neosfer GmbH

Eschersheimer Landstr 6

60322 Frankfurt am Main

Teil der Commerzbank Gruppe

+49 69 71 91 38 7 – 0 info@neosfer.de presse@neosfer.de bewerbung@neosfer.de