22min reading time

The EU taxonomy at a glance

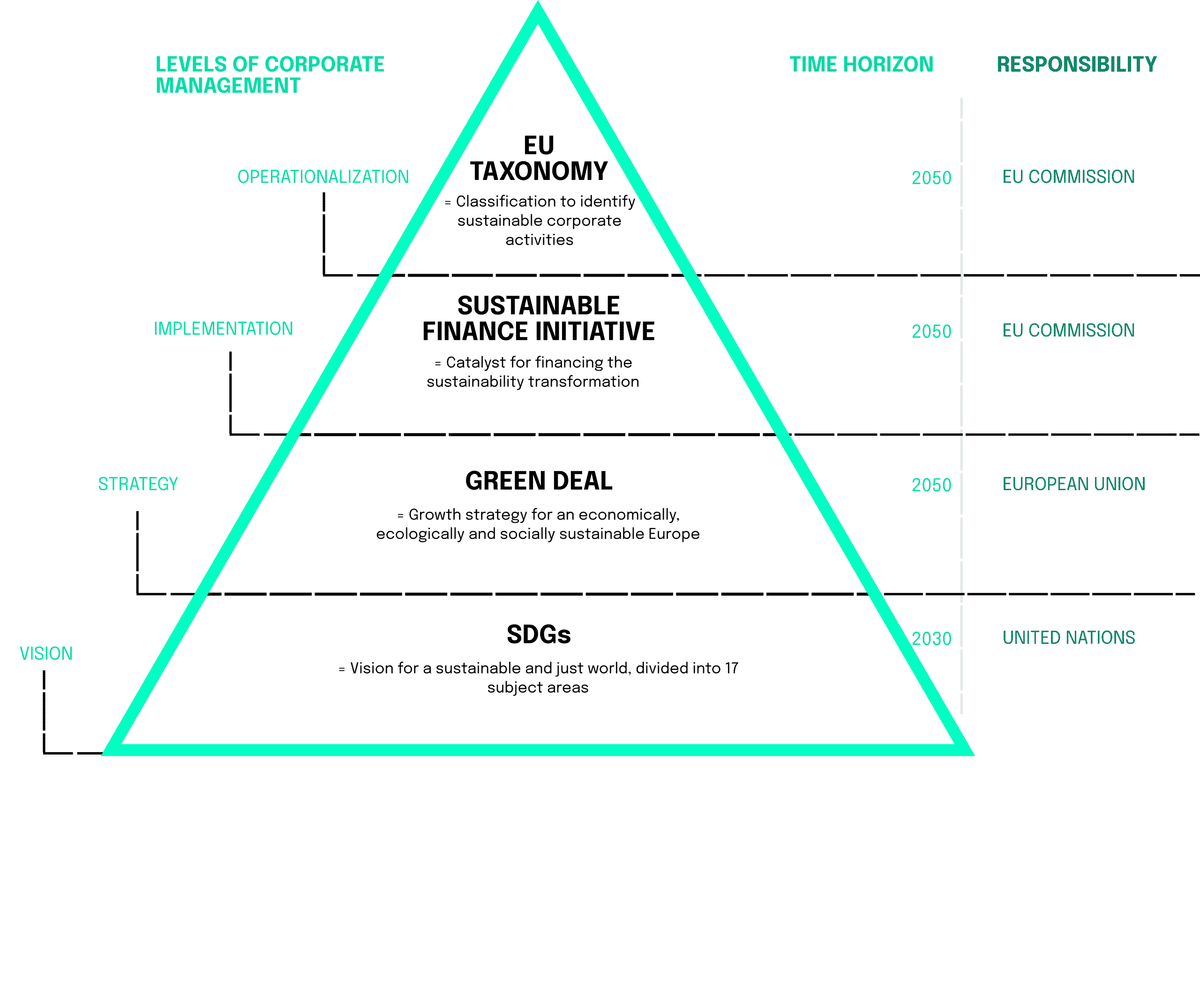

Festlegung nachhaltiger Aktivitäten und Ziele der Taxonomie

- Make a substantial contribution to at least one environmental objective

- Do no significant harm (DNSH) to any other environmental objective

- Complying with minimum social safeguards

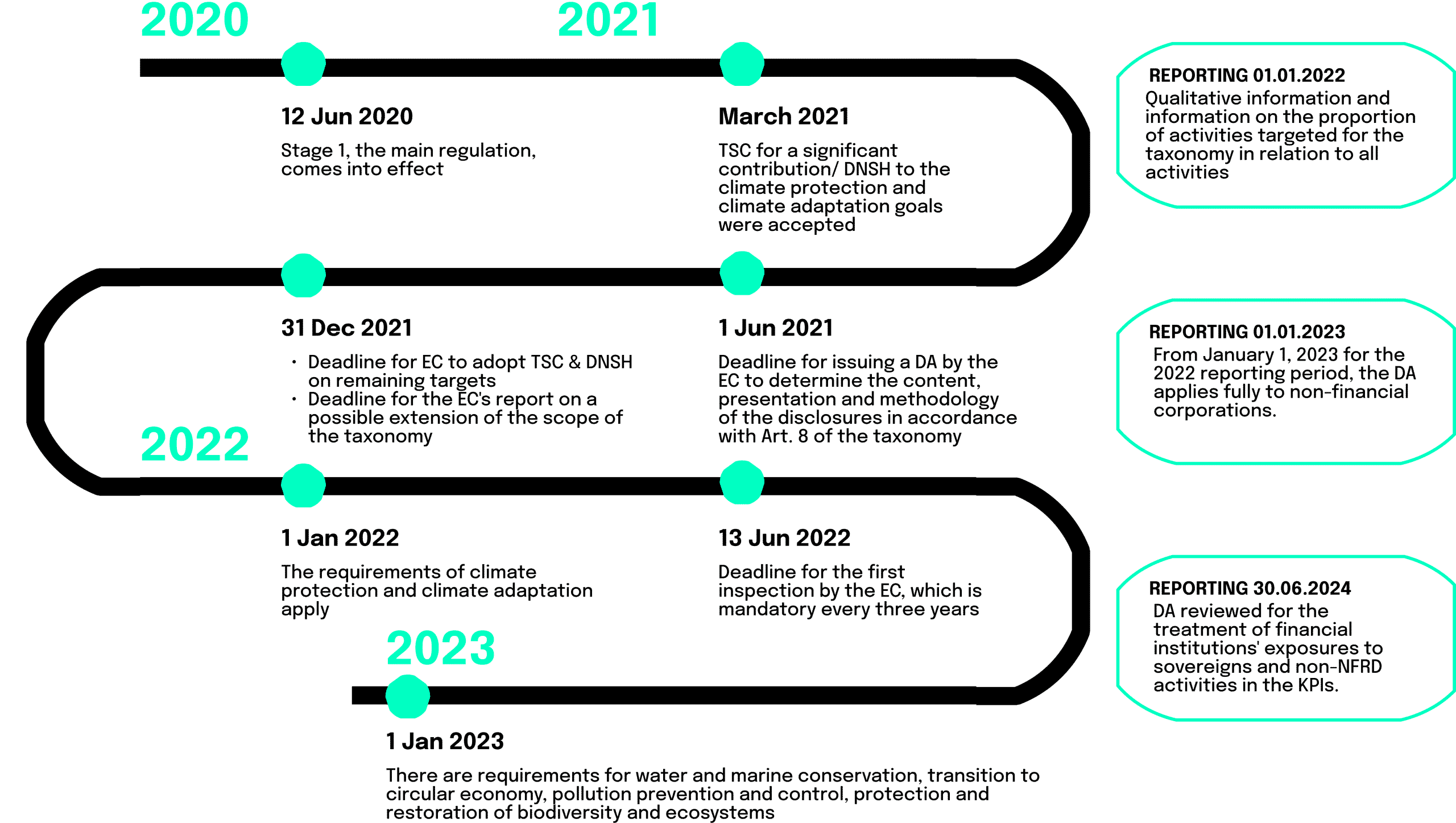

In welchem Zeitraum wird die Taxonomie implementiert?

- As of 1st January 2022 for the reporting period 2021, only qualitative information and information on the proportion of Taxonomy-eligible activities in relation to total activities must be disclosed.

- As of 1st January 2023 for the reporting period 2022, the Delegated Act will apply fully to non-financial undertakings. Starting the 1st January 2024 for the reporting period 2023 to financial undertakings with the understanding that certain exposures and investments of financial institutions, including in sovereign debt and non-NFRD (Non-Financial Reporting Directive)undertakings, may not have been fully reflected in their KPIs yet.

- By 30 June 2024, the delegated act will be reviewed in particular regarding the treatment in the KPIs of exposures of financial undertakings to sovereigns and non-NFRD undertakings.

Who must report in the future?

The Taxonomy regulations will require European companies, which are currently subject to the NFDR, to provide Taxonomy-compliant non-financial reports. This allows investors in European listed companies to find not only eligible activities in the company report. They can also see the percentage of the company’s revenue, investment and operating expenses related to the classification.

The Taxonomy regulation (2020/852/EU) applies to the financial sector and companies, which are subject to the obligations of publishing a non-financial statement on a company or group level. This can be seen as the first step of companies which need to report. Current EU rules on non-financial reporting apply to large companies and public-interest entities with more than 500 employees. This covers approximately 11,700 large companies and groups across the EU, including listed companies, banks, insurance companies, and other companies designated by national authorities as public-interest entities. Directive 2014/95/EU on the disclosure of non-financial and diversity information (NFRD) has set the EU on a clear course towards greater business transparency and accountability on social and environmental issues. However, as we already highlighted in our overview article about the EU-wide regulations, the NFRD is being replaced by the CSRD. The Corporate Sustainable Reporting Directive (CSRD) will entirely change the reporting requirements of many companies in Europe and can be understood as one of the operationalization of the EU Taxonomy.

Nonetheless, in 2022, the listed companies with over 500 employees should report the proportion of Taxonomy-eligible activities as turnover, capital expenditures (CaPex), and operational expenditures (OpEx) related to their economic activities in the year 2021.

This eligibility reporting helps companies to prepare for their Taxonomy alignment disclosures. In 2023, companies should report their turnover, capital expenditure and operational expenditure in relation to the environmentally sustainable economic activities that align with the EU Taxonomy criteria defined in the Climate Delegated Act.

The question now is how companies, and especially Venture Capital firms must adopt their reporting and how they can comply with the new rules being implemented next year.

How will financial organizations feel the changes in regulations?

While the Taxonomy is primarily a classification tool, it also has other functions. For example, it requires the above-mentioned companies to disclose information concerning the degree of alignment of their activities with the Taxonomy. This is achieved by amending the disclosure requirements in the EU’s NFRD and the Sustainable Finance Disclosure Regulation (SFDR).

In accordance with the EU Taxonomy regulation and related legislation, investments are directed towards sustainable economic activities. Companies and investors are provided with a robust and science-based framework for determining which economic activities significantly contribute to the EU Green Deal. These frameworks are especially important for Venture Capital Investors (VCs) to classify their investment activities. If your VC also creates own products, services or ventures, you additionally need to classify these actions as well. So, the next part of this article will help you in making your reporting future-proof!

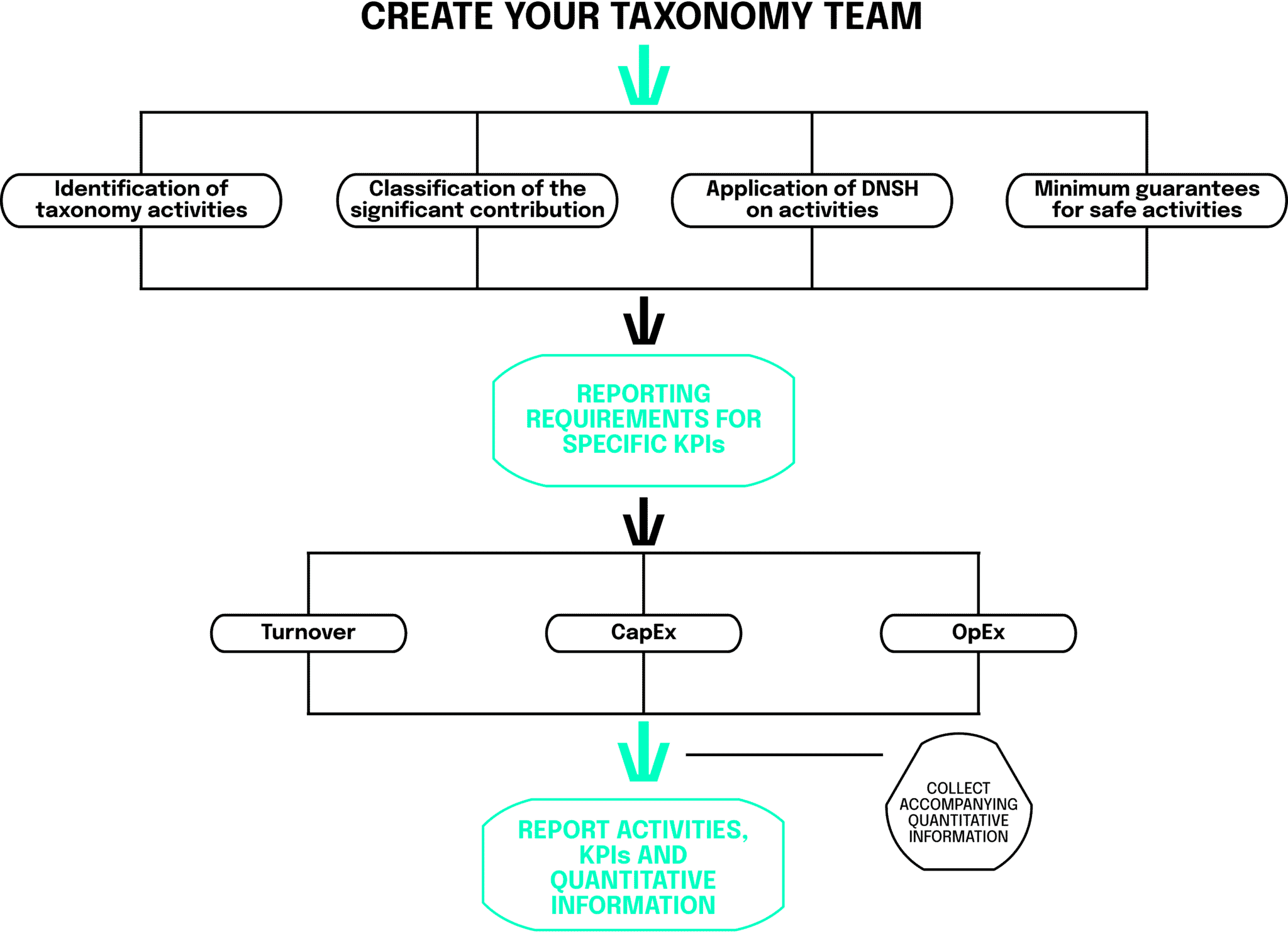

To report on the key performance indicators (KPIs) like turnover, CapEx and OpEx related to the Taxonomy-aligned activities, companies should categorize their economic activities according to the substantial contribution criteria, do-no-significant-harm requirements, and minimum social safeguards. In the following section, we will use the eight critical steps defined by Ecobio Manager for a VC to comply with the EU Taxonomy in its current state of development. Ecobio launched the world’s first real digital solution to comply with the EU Taxonomy and is therefore a good role model to follow.

Ecobio's eight steps for compliant reporting

The Taxonomy work process can be divided into classification and reporting requirements. The process starts by creating a list of economic activities and assessing their Taxonomy-eligibility. If an economic activity is included in a delegated act, it means that this activity can make a substantial contribution to one or more environmental objectives under the Taxonomy regulation and must be included into the reporting required under the EU Taxonomy.

If your economic activity is eligible, you continue to assess the alignment of your activity with the Taxonomy requirements. Finally, you will need to define the key performance indicators, combine the financial data with the classification data, and disclose the results. An extensive process that needs to be conducted in a structured manner. However, being a VC for sure has its advantages when complying with the Taxonomy. Typically, a VC will get profound insights into their invested companies, making it easier to assess their sustainable direction. As the sustainable direction of the VC, of course, is tied to the sustainable behavior of the invested companies, these insights are of utmost importance. A VC that is required to report, must disclose information as part of their non-financial statement, following Article 19a of the NFRD (2014/95/EU).

Step 1: Gather your Taxonomy team

- The sustainability expert and the investment manager classify the economic activity of the VC’s operation throughout the year.

- The finance professional calculates and reports the KPIs’ primary data and disclosure.

- The legal expert makes sure that the reporting is compliant with legal requirements stated in the EU Taxonomy, SFDR, the NFDR or in the future the CSRD

Step 2: Identify your Taxonomy-eligible economic activities

The first task of your team is to identify potential economic activities of the VC by using the defined list of Taxonomy activities. Companies shall identify each economic activity, including a subset of transitional and enabling economic activities. What are these transitional and enabling activities, and how can you define Taxonomy-aligned activities overall?

The Climate Delegated Act provides a set of Taxonomy activities. defined as critical for climate change mitigation and climate change adaptation. Study, if your company has any activities that can be eligible with those definitions of Taxonomy activities. But be aware, the full Climate Delegated Act has over 340 pages full of information! The Taxonomy activities are linked to the NACE (Nomenclature of Economic Activities) codes in the Taxonomy system. NACE is the European statistical classification of economic activities, which groups organizations according to their business activities. You can use that linkage with assessing the eligibility of your economic activities. However, keep in mind that just using this linkage between NACE and the Taxonomy most likely will lead you to disclose too low eligibility with the Taxonomy. A specific overview with a Q&A for financial institutions can be found here.

To nonetheless give a broad overview of what the EU Taxonomy defines as eligible activities, here are three criteria that need to be fulfilled:

- Making a substantial contribution to at least one environmental objective

- Doing no significant harm to any other environmental objective

- Complying with minimum social safeguards

The Taxonomy also defines two classification categories: enabling activities and transitional activities. These are added to allow activities which may not otherwise have been considered sustainable to contribute to the overall objective of promoting sustainability. More on these enabling and transitional activities can be found in the EU Taxonomy Compass.

Step 3: Classification of the substantial contribution

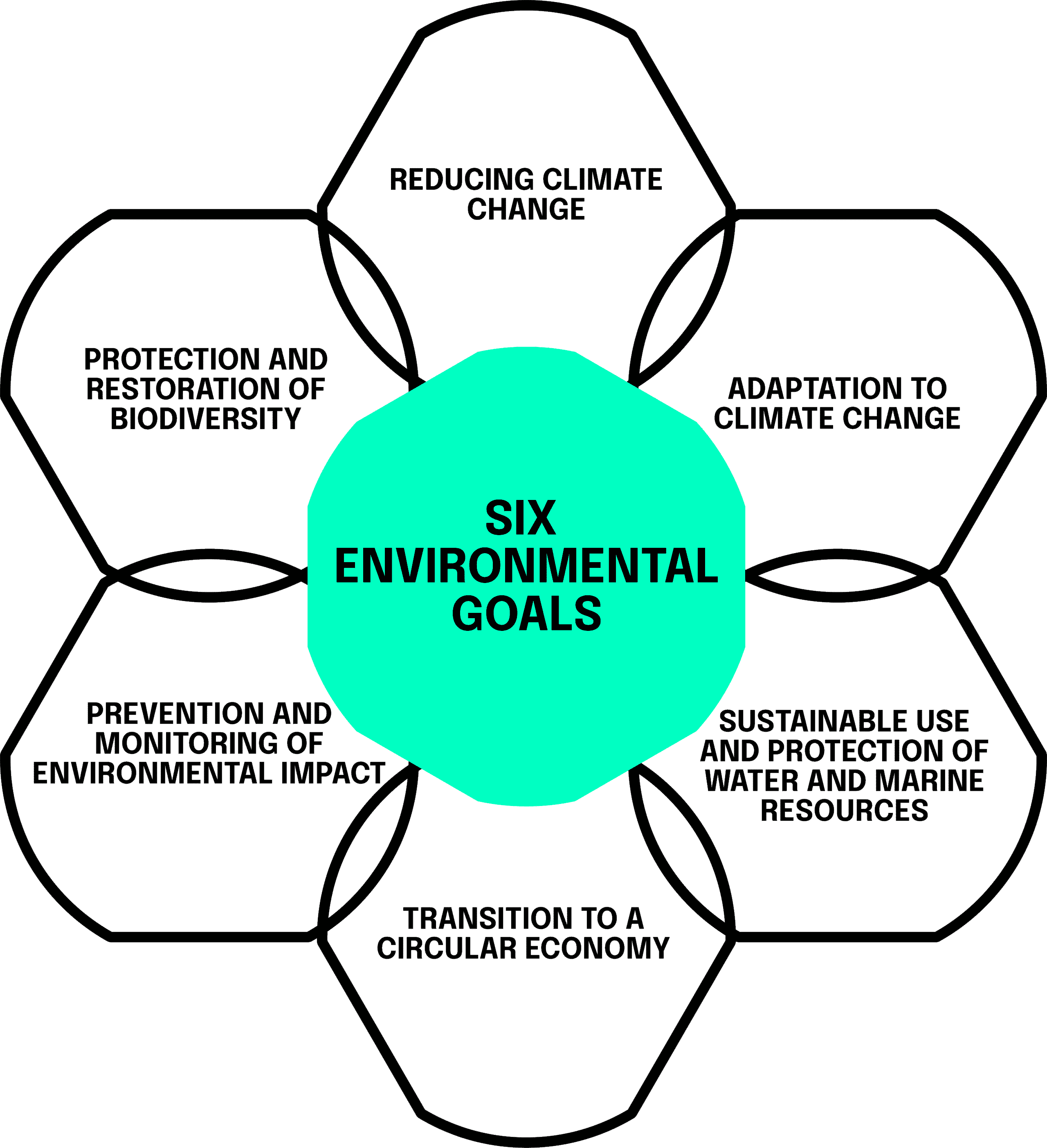

To put it straightforward: For an activity to be Taxonomy-aligned, it must meet strict conditions. The first one is to make substantial contribution to at least one of the six environmental objectives. Under the EU Taxonomy, an activity will be defined as substantially contributing via the avoidance of emissions of greenhouse gases (GHGs), reduction of GHG or removing them from the atmosphere.

Where there is no possible low carbon elective, the EU Taxonomy likewise perceives that specific actions and activities can qualify as making a significant commitment to the progress to a net-zero economy. This is the time to apply the enabling and transitional activities. Explicit conditions will be determined in the TSC; these should address best-in-industry GHG outflows reduction, not hamper the creation of low carbon options and not prompt a lock-in of carbon concentrated resources.

Step 4: Classification of activities that do not cause significant harm

The second part of the Taxonomy classification is to assess the do no significant harm criteria (DNSH). There is an explicit difference between requirements for ‘substantial contribution’ and ‘doing no significant harm’. While the activity, of course, should contribute towards the six predefined goals, the DNSH assessment considers the life cycle that results from the activity. Within this life cycle, the activity cannot have a significant negative environmental impact. So, VCs need to look in both directions when defining their activities as Taxonomy-aligned.

You should take into consideration the environmental impacts of the economic activity itself and the environmental impacts of the production, use, and end of life of the products and services created by the activity. The Climate Delegated Act sets out different criteria for the assessment. Additionally, you also need to assess compliance with the required legislation and environmental risk assessment

Step 5: Classification of minimum social safeguards for business activities

- the OECD Guidelines for Multinational Enterprises,

- the UN Guiding Principles on Business and Human Rights, ,

- die ILO declaration on the Fundamental Principles and Rights at Work,

- die fundamental conventions of the ILO on human and labour rights,

- die International Bill of Human Rights,

- and the principles set out in the European Pillar of Social Rights.

Step 6: Define turnover, CapEx and OpEx

This year, reporting-required companies only disclose information about Taxonomy-eligible and non-eligible activities for the environmental objectives of climate change mitigation and climate change adoption. As of January 2023, companies must also disclose the proportion of Taxonomy-aligned economic activities in their total turnover, capital expenditures, and operating expenditures. This KPI reporting must be supported by qualitative information defined by the European Commission. An overview of the accompanying qualitative information can be found here! As this document already is over 50 pages long, we summarize the most important findings in step 7 to make your life as easy as possible.

The information must be provided at the company level where that organization prepares individual non-financial statements or at the group level where it prepares consolidated non-financial statements. This, of course, is dependent on the structure of your VC and organization and must be considered when complying with the Taxonomy. Everything is defined in the Commission Delegated Regulation

Total turnover

The reporting of total turnover gives a first indication of how sustainable a VC already does business. The total turnover shows how aligned the organization is with larger environmental goals, defined by the Taxonomy and the big picture by the SDGs of the United Nations (UN). All companies must disclose the proportion of turnover derived from products and services associated with Taxonomy-aligned activities. Intangible products and services are included as well. Turnover regarding the proportion of Taxonomy-aligned activities is based on the same calculation stated in the international accounting standards that apply to the preparation of the company’s financial statements. An overview of the IFRS regulations can be found here

Capital expenditures CapEx informs about the future-looking perspective of a company to transform their economic activities and align them with the environmental goals set by the EU Taxonomy. Companies will need to disclose the proportion of their capital expenditures related to assets or processes aligned with the Taxonomy. Capital expenditures that are planned to extend or reach Taxonomy-alignment are included into the calculation as well. Here, the calculation of the CapEx must be based on the same accounting principles that are used for the regular financial statements and reporting of regular CapEx.

- property, plant, and equipment mentioned in IAS 16 erwähnt werden,

- intangible assets inIAS 38,

- investment property inIAS 40and several other points,

- agriculture mentioned inIAS 41

- and leases mentioned in IAS 16 as well.

-

- related to assets or processes that are associated with Taxonomy-aligned economic activities,

- part of the CapEx plan, or

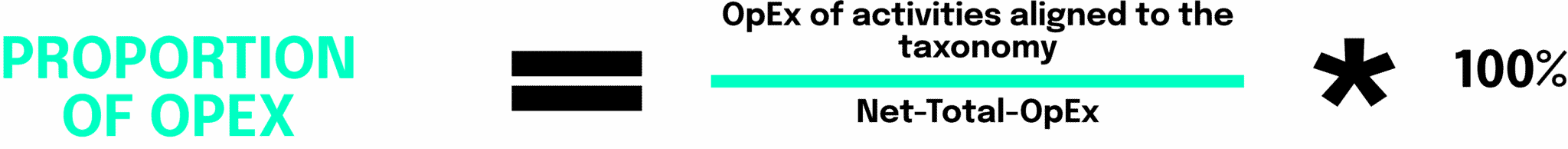

Operating expenditures

Companies additionally must disclose the proportion of operating expenditures related to assets or processes which are Taxonomy-aligned economic activities or related to the CapEx plan.

The denominator will report all non-capitalized costs that are related to R&D efforts, renovation measures, short-term lease, maintenance and repair, and any other direct expenditures relating to the day-to-day servicing of assets of the property, plant, and equipment. These costs must be necessary to ensure the continued and effective use of the asset.

The numerator equals to all the parts of the OpEx included in the denominator that are either

- related to assets and processes associated with Taxonomy-aligned economic activities, including training and other human resources adaption needs, and direct R&D efforts included in non-capitalized costs,

- part of the CapEx plan, or

- related to the purchase of output from Taxonomy-aligned economic activities and individual measures enabling the target activities, provided that the measures are operational within 1.5 years.

Same as for the calculation of the CapEX, please check the details from the IFRS or GAAP principles, including national implementation of the principles.

Nachdem die drei wichtigsten quantitativen KPIs definiert wurden, müssen diese Kennzahlen jetzt berichtet werden, um das Unternehmen an die Berichtsanforderungen der EU-Taxonomie anzupassen. Außerdem müssen zusätzliche qualitative Informationen zusammengestellt werden.

After you have defined the three most important quantitative KPIs, you must report to align your company with the reporting requirement of the EU Taxonomy. You must also compile additional qualitative information.

Step 7: Compile accompanying qualitative information

Accounting policy

You must explain how you

- determined and allocated turnover, CapEx and OpEx to the numerator,

- and created the basis for the calculation of the KPIs, including any assessment in the allocation of revenues and expenditures to the different economic activities.

You should describe the nature of the Taxonomy-eligible and Taxonomy-aligned activities and explain how compliance with technical criteria is assessed. These are basically the reports about your needed internal guidelines that help you in the assessment of the activities.

Contextual information about turnover, CapEx, and OpEx

You must report explanations about the KPIs. This includes a qualitative breakdown of the numerators you used for the calculation of turnover, CapEx, and OpEx. Additionally, you must also report on the changes from one financial year to the next one regarding the KPIs.

Step 8: Disclose the Taxonomy-aligned activities in KPIs and accompanying qualitative information

Impact of the EU Taxonomy

Now, there is just one final question that must be answered: Is this effort all worth it, and what is the impact of all this reporting and new frameworks defined by the EU Taxonomy?

As the Taxonomy takes shape, it may be applied in new ways. We have seen the Eu Taxonomy being used to define the new EU Green Bond Standard which used the Taxonomy as the benchmark for eligibility. Linking the Taxonomy to the Green Bond Standard has created a more direct link between EU capital markets, financial instruments and sustainable behavior and transformation. The recently created EU Ecolabel for retail financial products already includes Taxonomy defined thresholds for minimum investment in environmentally sustainable economic activities.

So, besides defining new reporting requirements for financial institutions, and creating frameworks to classify sustainable behavior and activities, the EU Taxonomy framework will reduce reputational and environmental risks. Through it, financial institutions can create additional value for clients, and employees or partners. As it will be possible in the future to clearly show if sustainable considerations are considered or if statements are just used for greenwashing. With tools provided by companies like Ecobio, it will also be possible to efficiently and effectively comply with the upcoming regulatory requirements.

Even if your financial company is not required to disclose the information under the EU Taxonomy, you can use all the frameworks and reporting requirements to disclose the information voluntarily. Additionally, a VC could use the EU Taxonomy as a new investment strategy to make more sustainable investments in the future, as the framework clearly highlights, which products, services and activities will be defined as sustainable. Therefore, the Taxonomy will contribute towards the most relevant sustainable investment strategies, which we highlighted in a previous article found here , and can act as a capital allocation guide as well.

Amenta, C., Riva Sanseverino, E. & Stagnaro, C. (2021). Regulating blockchain for sustainability? The critical relationship between digital innovation, regulation, and electricity governance. Energy Research & Social Science, 76, 102060.

https://doi.org/10.1016/j.erss.2021.102060

Bai, C. & Sarkis, J. (2020). A supply chain transparency and sustainability technology appraisal model for blockchain technology. International Journal of Production Research, 58(7), 2142–2162. https://doi.org/10.1080/00207543.2019.1708989

Binder, M. (2022, 2. Mai). Bored Ape Yacht Club caused Ethereum fees to soar to astronomical levels. Mashable. Abgerufen am 20. Mai 2022, von https://mashable.com/article/ethereum-gas-fees-skyrocket-bored-ape-yacht-club-otherside-nft-launch

BMUV. (2022, 1. Januar). Sprint-for-Green. Abgerufen am 23. Mai 2022, von https://www.bmuv.de/digitalagenda/produktpass/pkw-batterie

Chainlink. (2022, 24. Mai). New Report: Blockchains and Oracles Are Redefining the Energy Industry. Chainlink Blog. Abgerufen am 27. Mai 2022, von https://blog.chain.link/blockchains-and-oracles-are-redefining-the-energy-industry/

Coinbase. (2022, 15. Januar). A simple guide to the Web3 stack – The Coinbase Blog. Medium. Abgerufen am 8. Mai 2022, von https://blog.coinbase.com/a-simple-guide-to-the-web3-stack-785240e557f0

Ethereum. (2022, 27. Mai). Ethereum upgrades (formerly ’Eth2’). Ethereum.Org. Abgerufen am 27. Mai 2022, von https://ethereum.org/en/upgrades/

Figueiredo, K., Hammad, A. W., Haddad, A. & Tam, V. W. (2022). Assessing the usability of blockchain for sustainability: Extending key themes to the construction industry. Journal of Cleaner Production, 343, 131047. https://doi.org/10.1016/j.jclepro.2022.131047

Friedman, N. & Ormiston, J. (2022). Blockchain as a sustainability-oriented innovation?: Opportunities for and resistance to Blockchain technology as a driver of sustainability in global food supply chains. Technological Forecasting and Social Change, 175, 121403. https://doi.org/10.1016/j.techfore.2021.121403

Gemini. (2022, 5. März). Blockchain Trilemma: Scaling and Security Issues. Abgerufen am 14. Mai 2022, von https://www.gemini.com/cryptopedia/blockchain-trilemma-decentralization-scalability-definition

Mcshane, G. (2022, 11. Januar). What are Gas Fees? CoinDesk. Abgerufen am 11. Mai 2022, von https://www.coindesk.com/learn/what-are-ethereum-gas-fees/

Parmentola, A., Petrillo, A., Tutore, I. & de Felice, F. (2021). Is blockchain able to enhance environmental sustainability? A systematic review and research agenda from the perspective of Sustainable Development Goals (SDGs). Business Strategy and the Environment, 31(1), 194–217. https://doi.org/10.1002/bse.2882

Pizzi, S., Caputo, A., Venturelli, A. & Caputo, F. (2022). Embedding and managing blockchain in sustainability reporting: a practical framework. Sustainability Accounting, Management and Policy Journal, 13(3), 545–567. https://doi.org/10.1108/sampj-07-2021-0288

Ronaghi, M. H. & Mosakhani, M. (2021). The effects of blockchain technology adoption on business ethics and social sustainability: evidence from the Middle East. Environment, Development and Sustainability, 24(5), 6834–6859. https://doi.org/10.1007/s10668-021-01729-x

Schinckus, C. (2020). The good, the bad and the ugly: An overview of the sustainability of blockchain technology. Energy Research & Social Science, 69, 101614. https://doi.org/10.1016/j.erss.2020.101614

- Geschäftsführer neosfer

Lorem ipsum dolor sit amet, consetetur sadipscing elitr, sed diam nonumy eirmod tempor invidunt ut labore et dolore magna aliquyam erat, sed diam voluptua. At vero eos et accusam et justo duo dolores et ea rebum. Stet clita kasd gubergren, no sea takimata sanctus est Lorem ipsum dolor sit amet. Lorem ipsum dolor sit amet,

These might interesst you

Further News

neosfer GmbH

Eschersheimer Landstr 6

60322 Frankfurt am Main

Teil der Commerzbank Gruppe

+49 69 71 91 38 7 – 0 info@neosfer.de presse@neosfer.de bewerbung@neosfer.de